Income Tax Acc - Exam 2

1/73

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

74 Terms

Income Tax Formula

Gross Income

Less: Deductions for AGI

Adjusted Gross Income (AGI)

Less: Deductions from AGI

Less: Qualified Business Income (QBI) Deduction

Taxable Income

Tax

Less: Tax Credits

Tax Liability

Less: Prepayments

Tax Due (or Refund)

Common Deductions for AGI (Exhibit 4-5)

alimony paid (pre-2019 divorce decree)

health insurance deduction for self-employed taxpayers

rental & royalty expenses

net capital losses (limited to 3k, only 1.5k for married filing separately)

one-half of self-employment taxes paid

business expenses

losses on dispositions of assets used in a trade or business

contributions to qualified retirement accounts (401k plans & traditional individual retirement accounts, IRAs)

Significance of AGI

important reference point that is used in other tax calculations

Examples of Itemized Deductions (Schedule A, exhibit 4-6)

medical & dental expenses

taxes

interest expense

gifts to charity

other miscellaneous deductions

Child Tax Credit Rules

qualify for $2,200 if under age 17 at yr end

qualify for $500 for qualifying dependents who do not meet the requirements for higher credit amount

Tests for Qualifying Child

Relationship

Age

Residence

Support

Test for Qualifying Relative

Relationship

Support

Gross Income

Other

Relationship Test for Qualifying Child

is taxpayer’s child, stepchild, foster child, sibling, half-sibling, stepsibling, or a descendant of any of these relatives

Age Test for Qualifying Child

younger than the taxpayer claiming the individual as a qualifying child

under age 19 or a full-time student under age 24

also anyone totally & permanently disabled

Residence Test for Qualifying Child

lives w/ taxpayer for more than half of the yr

includes temporary absences for things such as illness & education

Support Test for Qualifying Child

the qualifying child must not provide more than half of their own support

Relationship Test for Qualifying Relative

Taxpayer’s descendant or ancestor, sibling, stepparent, stepsibling, child of taxpayer’s sibling, sibling of the taxpayer’s parents, in-laws, & anyone else who has the same principal place of abode as the taxpayer for the entire year (even if not otherwise related)

Support Test for Qualifying Relative

taxpayer must have provided more than half of the support for the qualifying relative

Gross Income Test for Qualifying Relative

Gross income of the relative is less than $5,200 in 2025

Other Test for Qualifying Relative

must not be a qualifying child

Tiebreaking Rules for Qualifying Child

if the person is a qualifying child of a parent & a nonparent, the parent is entitled or has priority to claim the person as a dependent

if the individual is a qualifying child to more than one parent, the parent whom the child has resided for the longest period of time during the yr has priority

if the child resides w/ each parent for equal amounts of time during the yr, the parent w/ the higher AGI gets to claim the child as dependent

if the child is a qualifying child of more than one nonparent, the nonparent w/ the highest AGI gets to claim the child as dependent

What constitutes support / multiple support agreements?

no one taxpayer paid over ½ of the individual’s support for the yr

the taxpayer & at least one other person together provided more than half the support of the individual, & the taxpayer and the other person(s) would have been allowed to claim the individual as a dependent except for the fact they did not provide half the support individually

the taxpayer contributed over 10% of the individual’s support for the yr

each other person who provided over 10% of the individual support provides a signed statement to the taxpayer agreeing not to claim the individual as a dependent

commonly used in situations when siblings support elderly parents

Types of Filing Statuses

single

married filing separately

married filing jointly

qualifying surviving spouse

head of household

Requirements for Single Status

unmarried as of the last day of the yr

or legally separated from their spouse under a divorce or separate maintenance decree

does not qualify for any of the other filing statuses

Requirements for Married Filing Separately Status

taxpayers are legally married as of the last day of the yr

generally no tax advantage to filing separately (usually a disadvantage)

each spouse is ultimately responsible for paying their own tax

couples may choose to file separately (generally for nontax reasons)

Requirements for Married Filing Jointly Status

must be legally married as of the last day of the yr

if one spouse dies, the surviving spouse is considered to be married to decedent spouse at yr end

exception: the surviving spouse remarries before yr’s end

both spouses responsible for paying joint tax

Requirements for Qualifying Surviving Spouse Status

when a taxpayer’s spouse dies, the surviving spouse can file as a qualifying surviving spouse for 2 yrs after the yr of the spouse’s death if the surviving spouse remains unmarried & maintains a household for a dependent child

Requirements for Head of Household Status

unmarried as of the last day of the yr

or legally separated from their spouse under a divorce or separate maintenance decree

not be a qualifying surviving spouse

pay more than half the costs of keeping up a home for the yr

have a qualifying person live in the taxpayer’s home for more than half the yr

excludes temporary absences for military service, illness, or education

if the person is the taxpayer’s parent, the parent is not required to live w/ the taxpayer

Qualifying Person Requirements for Head of Household Status

may not qualify more than one person for head of household filing status

if taxpayer can only claim a person as dependent bc of multiple support agreement, that person is not a qualifying person

if a custodial parent agrees under divorce decree to allow the noncustodial parent to claim the person as a dependent, the agreement is ignored for purposes of the head of household filing status test

Gross Income (IRC 61)

means all income from whatever source derived

includes income realized in any form, whether in money, property, or services

recognized when:

they receive an economic benefit

they realize the income

the tax law does not provide for exclusion or deferral

Economic Benefit

borrowed funds represent a liability, not gross income

Realization Principle

taxpayer engages in a transaction w/ another party

transaction results in a measurable change in property rights

Recognition

realized income is assumed to be recognized absent a deferral or exclusion provision

Accrual Method

income recognized when earned

expenses deducted in the period when liabilities are incurred

mostly used by large corps

Cash Method

income recognized when received

expenses deducted when made rather than when liabilities are incurred

mostly used by individuals

Constructive Receipt Doctrine

judicial doctrine that provides that a taxpayer must recognize income when it is actually or constructively received

deemed to have occurred if the income has been credited to the taxpayer’s account or if the income is unconditionally available (accessible w/o limits) to the taxpayer, the taxpayer is aware of the income’s availability, & there are no restrictions on the taxpayer’s control over the income

for cash method users

Claim of Right Doctrine

judicial doctrine that states that income has been realized if a taxpayer receives income & there are no restrictions on the taxpayer’s use of the income

addresses when a taxpayer receives income in one period but is required to return the payment in a subsequent period

potentially have to repay but currently no restrictions on the use of income

Assignment of Income

judicial doctrine holding that earned income is taxed to the taxpayer providing the service

income from property is taxed to the individual who owns the property when the income accrues

to shift income from property to another person, a taxpayer must also transfer ownership in the property to the other person

Earned Income

income from services

income from labor most common source of gross income

generated by the efforts of taxpayer

Unearned Income

income from property

includes gains or losses from sale of property, dividends, interests, rents, royalties, & annuities

depends on type of income & type of transaction generating income

Examples of Earned Income

wages

salary

fees that a taxpayer earns through services

unemployment compensation

Examples of Unearned Income

gains or losses from sale of property

interest

dividends

rents

royalties

annuities

Concept of Income from Flow-Through Entities

applies to legal entities, like partnerships, LLCs, and S corps, that do not pay income tax

income and losses from these entities are allocated to their owners

each partner & shareholder report their share of the entity’s income & deductions in proportion to their ownership % on their individual tax return

Alimony

a transfer of cash made under a written separation agreement or divorce decree

the separation or divorce decree does not designate the payment as nonalimony

in the case of legally separated (or divorced) taxpayers under a separation or divorce decree, the spouses do not live together when the payment is made

the payments cannot continue after the death of the recipient

types of payments that do not qualify:

property divisions

child support payments fixed by the divorce or separation agreement

if executed before 1/1/2019, alimony is included in gross income of the recipient & deductible for AGI by the payor

if executed after 12/31/2018, alimony is not taxable to the recipient or deductible by the payor

Prizes / Awards / Gambling

raffles, sweepstakes prizes, or lottery winnings are included in gross income

exclusions rules:

for scientific, literary, or charitable achievement under certain conditions

for employee length of service or safety achievement ($400 tangible property limit per employee per yr)

to Team USA athletes from US Olympic Committee on account of their competition in Olympic & Paralympic games (AGI limit applies)

What constitutes a prize?

any valuable item you receive from a contest, drawing, sweepstakes, or lottery that must be included in your gross income

this applies to both cash and non-cash items, regardless of their value

What represents income for income tax purposes?

wages & salary

self-employment income

investment income

retirement income

gambling winnings, prizes, awards

unemployment compensation

alimony received from a divorce or separation agreement executed before 1/1/2019

Imputed Income

income from an economic benefit the taxpayer receives indirectly rather than directly

for low interest loans, the amount of imputed income is the difference between the amount of interest using the applicable federal interest rate & the amount of interest the taxpayer actually pays

The borrower is deemed to pay imputed interest

(interest expense to borrower, interest income to lender),

and then the lender is deemed to have returned the

imputed amount (the tax consequences depend on

relationship between borrower and lender).Imputed interest rules do not apply to aggregate loans of

$10,000 or less between the lender and borrower

Forgiveness of Debt

amount of debt relief is included in gross income by taxpayer

exceptions exist for certain types of loans

a discharge of indebtedness is not taxable for insolvent taxpayers

taxpayers w/ liabilities exceeding their assets

if the discharge of indebtedness makes the taxpayer solvent, the taxpayer recognizes taxable income to the extent of his solvency

taxpayers w/ assets > liabilities

regardless of solvency, taxpayers are also allowed to exclude from gross income most discharges of student loans after 2020 & before 2026

Scholarships

ones that pay for required tuition, fees, books, & supplies are excludable

applies only if the recipient is not required to perform services in exchange for receiving the scholarship (limited exception for tuition waivers for student employees & teaching & research assistants)

does not apply to dorming

529 Plans

taxpayers allowed to exclude from gross income earnings on investments in qualified education plans as long as they use the earnings for qualifying educational expenditures

Series EE Savings Bond Interest

can elect to exclude interest earned when the redemption proceeds are used to pay qualified higher-education expenses

the exclusion of interest is restricted to taxpayers w/ modified AGI below specific limits

When is Social Security Taxable?

Single taxpayers: if modified AGI + 50% of Social Security Benefits > $25,000

Taxpayers filing married separate: taxable if living together

Taxpayers filing married joint: if modified AGI + 50% of Social Security Benefits > $32,000

Annuities

an investment that pays a stream of equal payments over a time period

a portion of each annuity payment declared as a nontaxable return of capital & the remainder as gross income

taxpayers use the annuity exclusion ratio to determine the return of capital (nontaxable) portion of each payment

Annuity exclusion ratio = original investment / expected value of annuity

Taxation of Annuities

Return on capital principal

exclusion ratio = original investment / expected value of annuity

return on capital = payment times exclusion ratio

taxable amount = payment times (1 - exclusion ratio)

Taxation of Property Distributions

Selling Price

Less: Selling Expense

Adjusted Selling Price

Less: Adjusted Basis

Realized Gain / Loss

Gifts & Inheritances

individuals may receive property as gifts or from a decedent’s estate (inheritance)

while the receipt of property is most certainly real income to the recipient, the value of gifts & inheritances is excluded from gross income because these transfers are subject to a federal gift & estate tax

Life Insurance Proceeds

amounts received due to the death of the insured are excluded from the income of the recipient

similar to inheritances, they are typically subject to the federal estate tax

if the proceeds are paid over a period of time rather than in a lump sum, a portion of the payments represents interest & must be included in gross income

Taxable Fringe Benefits

employees recognize compensation income on all benefits received unless specifically excluded by tax laws

treats benefits received like taxable cash compensation

employer deducts cost & pays employee’s share of FICA taxes on benefit

employees must recognize a certain amount of gross income when employers pay life insurance premiums for the employee for policies w/ a death benefit in excess of $50,000

Employee Considerations for Taxable Fringe Benefits

employees may prefer it to an equivalent amount of cash when they benefit from employer-provided quantity or group discounts associated w/ the benefit

Computation for Annual Taxable Benefit

1) Subtract $50,000 from the death benefit of their employer-provided group-term life insurance policy

2) Divide the result in 1) by $1,000

3) Multiply the result in 2) by the cost per $1,000 of protection for one month from the table provided in the Treasury Regulations based on the taxpayer’s age

4) Multiply the result in 3) by 12 to annualize it

Nontaxable Fringe Benefits

Capital Assets

bought and held for appreciation potential

in general, an asset other than an asset used in a trade or business or an asset such as an account or note receivable acquired in a business from the sale of services or property

typically investment-type and personal-use assets

examples include:

artwork

corporate stock

bonds

personal residence

phone

Not Considered Capital Assets

asset used in trade or business

accounts or notes receivable acquired in business from sale of services or property

inventory

Amount Realized

the value of everything received by the seller in a transaction minus selling costs

Tax basis

the amount of a taxpayer’s unrecovered cost of or investment in an asset

generally the cost of acquiring the asset, including initial purchase price & other costs incurred to purchase or improve the asset

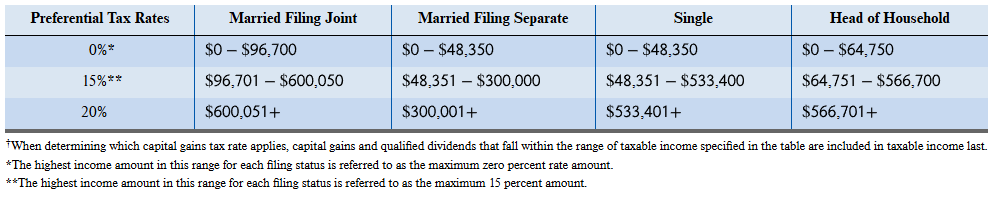

Tax Rates for Net Long Term Capital Gains

Tax Rate for Net Short Term Capital Gains

ordinary rates

Certain gains from the sale of depreciable real estate held long term are taxed at a maximum rate of _?

25%

Capital Assets taxed at 28%

collectibles: consists of art, rugs, antiques, metals, gems, stamps, coins, alcoholic beverages, or other similar items held for more than one yr

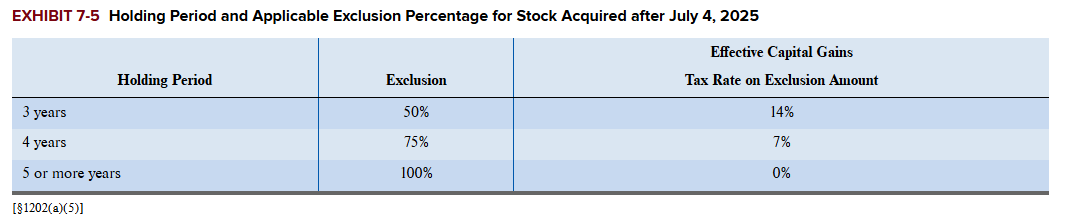

qualified business stock: stock received at original issue from a C corp w/ a gross tax basis in its assets both before & after the issuance of no more than $50,000,000 & w/ at least 80% of the value of its assets used in the active conduct of certain qualified trades or businesses

Exclusions of Tax for Qualified Business Stock Sold after being held for longer than 5 yrs

Netting Process for Capital Gains / Losses

1) combine ST gains/losses and separately combine LT gains/losses (including losses carried over from prior yrs)

2) if both ST & LT are both + or -, the net process is complete. ST taxed at ordinary & LT taxed at 0/15/20 percent

3) if ST & LT are not both + or -, then combine the results of ST & LT to get final net gain or net loss, depending on which outcome is greater determines whether it is ST or LT

Limits for Capital Loss Deductions

individuals can deduct up to $3,000 of net capital loss against ordinary income

remainder carries over indefinitely to subsequent yrs

Long-term requirments

held more than a yr

Short-term requirements

held for a yr or less

Appropriate Forms for Reporting Sales of Dispositions of Capital Assets

8949

1099-B

Schedule D

Losses on the Sale of Personal-Use Assets

gains are taxable as capital gains

losses are not deductible

Capital Losses on Sales to Related Parties

capital losses from sales to “related parties” are not deducted currently

the related party may eventually be able to deduct all, a portion, or none of the disallowed loss on a subsequent sale of the property

Wash Sale Rules

disallows the loss on stocks sold if the taxpayer purchases the same or “substantially identical” stock within a 61-day period centered on the date of sale

30 days before the sale

the day of sale

30 days after sale

intended to ensure that taxpayers cannot deduct losses from stock sales while essentially continuing their investment