Ch. 9 - Market Efficiency & Behavioral Finance

1/39

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

40 Terms

Random Walk Hypothesis

Theory that stock price movements are largely unpredictable

Definition: Efficient Market

A market that rapidly and fully incorporates new information

Efficient Markets Hypothesis (EMH)

Stock prices rapidly incorporate new information

Investors should not expect to consistently earn abnormal returns

Implies that consistently higher expected returns require more risk

If EMH is true:

Markets are efficient

Investors can expect higher returns only if they take more risk

Stock prices are not predictable

Actual returns will be higher/lower than expected returns due to luck

Abnormal returns are unpredictable

If EMH is NOT true:

Abnormal returns are predictable

Investors can earn high abnormal returns

Investors can earn consistently high returns without taking more risk

Active investing is a good strategy

Weak Form EMH

Past data on stock prices are not useful in predicting future stock price changes

Stock prices move at random

Semi-Strong Form EMH

Investors cannot consistently earn abnormally high returns using public information

Any price anomalies are quickly discovered and stock market adjusts

Strong-Form EMH

No information- public or private, allows investors to consistently earn abnormally high returns

Definition: Arbitrage

Type of transaction where the investor simultaneously buys and sells the same asset at a different price to earn an instant risk-free profit

Market Anomaly: Calendar Effects

Stock returns may be closely tied to the time of year or time of the week

Market Anomaly: Small-firm Effect

Small firms tend to earn positive abnormal returns of as much 5%-6% per year

Small firms may offer higher returns than larger firms, even after adjusting for risk

Market Anomaly: Post Earnings Announcement Drift

Stock price adjustments may continue after earnings adjustments have been announced

Pattern seems to create opportunity for investors to earn abnormal returns by purchasing stocks that have been issued good earnings news or by short selling stocks that have delivered poor earnings results

Market Anomaly: Momentum

Tendency for stock that have gone up recently to keep going up or tendency for stocks that have gone down to continue going down

Market Anomaly: Value Effect

On average, low P/E or market-to-book ratio stocks outperform high P/E or market-to-book ratio stocks

Uses P/E or market-to-book ratios to buy/sell stock

Behavioral Finance: Self-attribution Bias

Investors tend to take credit for success and blame factors out of their control for failures

Behavioral Finance: Loss Aversion

The tendency to exhibit risk-averse behavior when confronting gains and risk-seeking behavior when confronting losses

Behavioral Finance: Representativeness

Cognitive biases that occur because people have difficulty thinking about randomness in outcomes

Behavioral Finance: Overreaction

Investors overreact to a string of good performance and overestimate the likelihood that the trend will continue

Behavioral Finance: Narrow Framing

Investors tend to analyze a situation in isolation, while ignoring the larger context

Behavioral Finance: Belief Perseverance

Investors tend to ignore information that conflicts with their existing beliefs

Behavioral Finance: Anchoring

Individuals attempting to predict or estimate some unknown quantity place too much weight on information that they have at hand, even when that info is not relevant

Behavioral Finance: Familiarity Bias

Investors buy stocks that are familiar to them without regard to whether the stocks are good buys or not

Confidence Index

Measure that attempts to capture the tone of the market through bond returns

=(AVG Yield on 10 High-Grade Corp Bonds)÷(AVG Yield on 10 Intermediate-grade bonds)

Definition: Market Volume

Amount of investors interest in stocks

Increasing volume during a risking market is:

A positive sign that the upward movement in stocks will continue

Possible signal for end of bull market:

When stocks have been moving up and volume beings to drop off

Breadth of the Market

Looks at the number of stock prices that go up (advances) vs number of stock prices that go down (declines)

Market is strong when:

Advances outnumber declines

Market is weak when:

Declines outnumber advances

Advance-Decline Line

The difference between how many stocks closed higher and how many closed lower on a day

New Highs-New Lows

The difference between stocks reaching a 52-week high and stocks reaching a 52-week low

Used as a signal to buy or sell stocks

Short-Interest

The number of shares of stocks sold short in the market at any point in time

The more sold short, the higher it is

Can interpret:

Future Demand for Stock

Present Market Optimism/Pessimism

Odd-Lot Trading

Many small traders deal in transactions of fewer than 100 shares

Theory of Contrary Opinion

Assumes that small traders will do just the opposite of what should be done

Panic/sell when market is low

Speculate/buy when market is high

Uses the amount and type of odd-lot trading as an indicator of the current state of the market

When there is a significant difference between odd-lot purchases and sales:

This can signal a bull or bear market is about to end

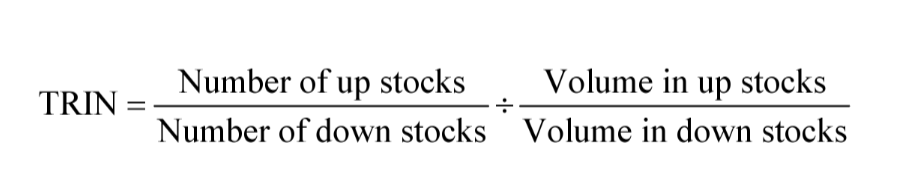

The Arms Index

Trading Index (TRIN)

Combines the advance-decline line with trading volume

High TRIN means bear market

Low TRIN means bull market

Mutual Fund Cash Ratio (MCFR)

Looks at the cash position of mutual funds as an indicator of future market performance

=Mutual Fund Cash Position ÷ Total Assets Under Management

On-Balance Volume (OBV)

A momentum indicator that relates volume to price change

Uses trading volume in addition to price and tracks trading volume as a running total

The direction/trend is important, not the actual value

Moving Average

Procedure that records the average value of a series of prices, or other data, over time

Smooths out a data series and makes it easier to spot trends

Charting

Shows a visual summary of as stock activity over time

Provides info about developing trends and future behaviors of the market or individual stocks