Macroeconomics Final Exam Study Guide

1/53

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

54 Terms

What is the "fundamental economic problem" that exists in every economy?

Scarcity- satisfying unlimited wants with limited resources. Forces people to make choices.

Scarcity

Insufficiency of resources to satisfy people's unlimited wants

Economics

How people work to transform resources into goods and services to distribute and satisfy wants

Difference between Macro and Micro economics

Micro- study of individuals or specific firms or industries

Macro- study of the economy as a whole

What economic model depicts the flow of money, goods, and services between households and firms?

Circular Flow Model

Opportunity Cost

quantity of goods that must be given up to obtain another good

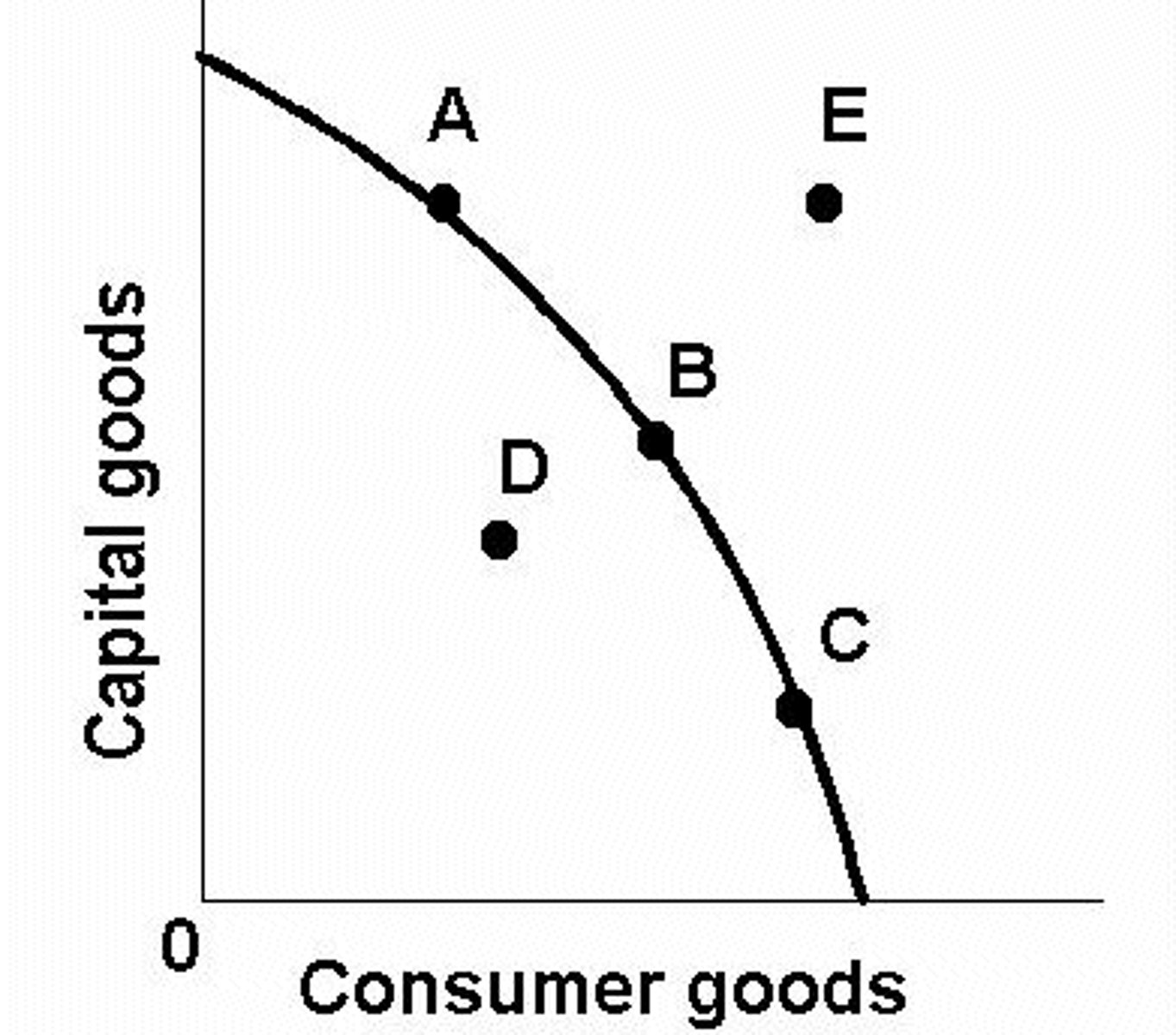

PPC - what is looks like and be able to determine opportunity cost and graph it

One good v another good

(look on study guide)

What shifts the PPC curve outward and inward

Inward- capital goods destroyed (natural disasters or war)

Outward- Innovations, new resources, new technology

Absolute v Comparative Advantage

Absolute- who can produce more of a good with fewer resources

Comparative- who can produce more of a good at a lower opportunity cost

Factors of Production

Land

Labor

Capital

Entrepreneurship

Define and Illustrate the Law of Supply and Demand

Demand- as price goes up, quantity demanded goes down and vice versa (inverse relationship between price and quantity demanded)

Supply- As price goes up quantity supplied goes up and vice versa (direct relationship between price and quantity supplied)

(See review for picture)

What causes a movement along the demand and supply curve

Changes in price

What are the determinants of supply and demand

Demand: change in income, taste/preferences, price of substitute/complementary goods, future expectations, population size

Supply: technology, resource prices, prices of related goods, number of suppliers, expectations of future prices

A Short-Run supply curve is drawn as _________ line. Long-Run is drawn as a _________line.

Upward Sloping,

Vertical

What does the horizontal segment of the aggregate supply curve indicate

Real GDP increase w/out affecting the economy's price level.

What are the determinants that would SHIFT the aggregate supply and demand curve

AS: input changes, change in productivity, changes in ACTION of government (Not gov't spending), environmental changes

AD: Changes in consumer spending, investment spending, gov't spending and net exports(exports-imports) *C+I+G+(X-M)*

When would demand-pull inflation most likely occur? Illustrate Demand-Pull Inflation on the aggregate model.

Aggregate demand curve increases pulling the price level up. Usually as a result of military expansion (increase in government spending)

(See study guide for graph)

Cost-Push inflation will most likely occur during? Illustrate Cost-Push Inflation on the aggregate model.

Aggregate supply curve decreases pushing the price level up. Usually as a result of an increase in cost of basic goods (OPEC in 1970's causes Stagflation in U.S.)

(See study guide for picture)

Be able to identify a shortage and a surplus using a supply and demand curve graph.

Surplus: QS >QD Shortage: QD > QS

(see graph on study guide)

__________ is the total value of all final goods and services produced in the economy (one country) during a given year, measured in current market prices.

___GDP____

The formula for GDP is GDP = C + I + G + (X - M). What does the C, I, G, X, and M stand for?

C = Consumer

I= Investment

G= Government

X= Export

M= Import

How does the "black market" impact GDP?

It is not included so it understates the actual value of GDP

What are the two different ways of counting GDP?

Expenditure Approach- total value of all goods and services (C+I+G+X-M)

Income Approach- total value of all resources used to make the goods and services

What is included in GDP and what is not counted in GDP?

Included: all FINAL goods and services

Not included: intermediate goods, value of housework, underground economy, cost of environmental damage, financial transactions, transfer payments, used goods, non-market activity

What is the difference between GDP and GNP?

GDP measures location (within a country's borders. Japanese owned company in U.S.)

GNP measures ownership (U.S. owned company overseas)

The Consumption Function equation C = a + bY is

a = autonomous consumption

b = marginal propensity to consume

Y = __LEVEL OF NATIONAL INCOME___

The part of national income that is not spent on consumption is defined as ____________.

_____SAVING_____

The formula for the Marginal Propensity to Save is

*1-MPC*

MPS = Change in ____SAVING_____ / Change in _____NATIONAL INCOME______

Define aggregate expenditure

Spending by consumers on consumption goods, spending by businesses on investment goods, spending by government and spending by foreigners on net exports

Define unemployment and the four different types of unemployment.

Unemployed: not having employment (a job) but actively seeking one.

(1) Frictional- brief, voluntary quit to seek better employment. Also includes initial job hunt after high school or college

(2) Structural- fundamental changes in production or substitution of new goods for customary ones

(3) Cyclical- associated with downturns and recession phases of business cycle

(4) Discouraged worker- given up after persistent rejection. NOT counted as part of labor force

Underemployed: employed in jobs not utilizing talents or experience

Who loses from inflation? Who Wins?

Losers: people on fixed income, landlords, workers with union-negotiated mulit-year fixed wage contracts, savers

Winner: borrowers and the government

Adam Smith identified four factors that contribute to the nation's economic growth.

Size of labor force, degree of labor specialization, size of capital stock, level of technology

Exchanging one good for another without the use of money is known as?

Barter system

What are the three primary functions of money?

Medium of exchange, measure of value, store of value

Liquidity

Degree to which an asset can easily be exchanged for money

M1 currency includes

Currency, demand deposits, travelers checks

M2 currency includes

M1 + savings accounts, money market mutual funds, money market deposit accounts, repurchase agreements, small-denomination time deposits

M3 currency includes

M2 + large-denomination time deposits and large repurchase agreements

Rank the least liquid to the most liquid forms of money

M3, M2, M1

The amount of assets that a bank must hold at all times is determined by what

Legal reserve requirement (set by the Fed)

What is the Legal Reserve Requirement? Be able to determine the growth of the money supply as a result of the Legal Reserve Requirement.

Sets the amount of currency from demand deposits banks must keep in vaults or at Fed district banks

Increase in LRR: decrease in $ supply

Decrease in LRR: increase in $ supply

What is the FED?

Federal Reserve- the central bank of the United States. 12 district banks across U.S.

What is the formula for the potential money multiplier?

1 / the _LEGAL RESERVE REQUIREMENT____

How much money will the FDIC insure demand deposit accounts for? What does the FDIC stand for

Federal Deposit Insurance Corporation. $100,000 (present day $250,000)

This is the responsibility of the ________ to hold bank reserves, provide banks with currency and loans, and clears checks.

____FED_____

What is the money supply? Be able to graph the money supply.

Supply of currency, demand deposits, and travelers checks used in transactions

(See study guide for graph)

What is the result of an increase and a decrease in the money supply?

What happens to interest rates? INC in $MS = DEC ir DEC in $MS = INC ir

What happens to investment? INC in $MS= INC in I DEC in $MS = DEC in I

What is the impact of GDP? INC in $MS = INC in GDP DEC in $MS = DEC in GDP

Two examples of automatic stabilizers are:

Unemployment

PERSONAL/CORPORATE INCOME TAXES (PROGRESSIVE TAXES)

The dominant school of thought from the late 19th century until the Great Depression of the 1930's was the ________.

_____CLASSICAL______

After the Great depression of the 1930's since WWII until the 1970's the ideas of the ____________ school became conventional wisdom.

____KEYNESIAN_____

Supply - side economists believe that lowering corporate income taxes will result in:

Increased after-tax profit, which induces suppliers to increase aggregate supply. This encourages people to work longer, which increases aggregate supply and tax revenue

Appreciation of U.S. currency means what? Depreciation of U.S. currency means what?

Appreciation- a rise in price of U.S. currency relative to foreign currency (stronger) Imports become less expensive

Depreciation- a fall in price of U.S. currency relative to foreign currency (weaker)

Imports become more expensive

What is the foreign exchange market?

Market where currencies of different nations are bought and sold

Define a Quota and a Tariff? Why are these used?

Quota- limit the quantity of a specific good that can be imported (increases domestic prices)

Tariff- tax on imported goods (domestic prices rise, quantity imported falls, domestic production increases)

To slow down international trade and restrict imports to boost domestic production