Chapter 11: Exchange Rates and Payments with the Rest of the World

1/28

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

29 Terms

Exchange Rate

Price one currency exchanges for another currency

Ex. if C$1.00 = US$0.90; it takes 90 cents US to buy 1 Canadian dollar

Foreign Exchange Market

Worldwide market where currencies bought and sold

The only people who are going to the foreign exchange market are those interested/needing another currency

Currency Depreciation vs. Appreciation

Currency Depreciation: fall in exchange rate of one currency for another

Ex. Before: $1 USD = ¥150 — After: $1 USD = ¥130

$1 USD buys less Euros

Currency Appreciation: rise in exchange rate of one currency for another

Ex. Before: $1 USD = €0.90 — After: $1 USD = €1.00

$1 USD buys more Euros

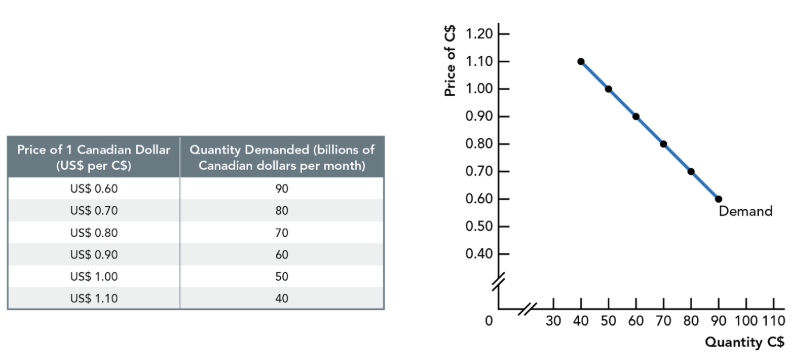

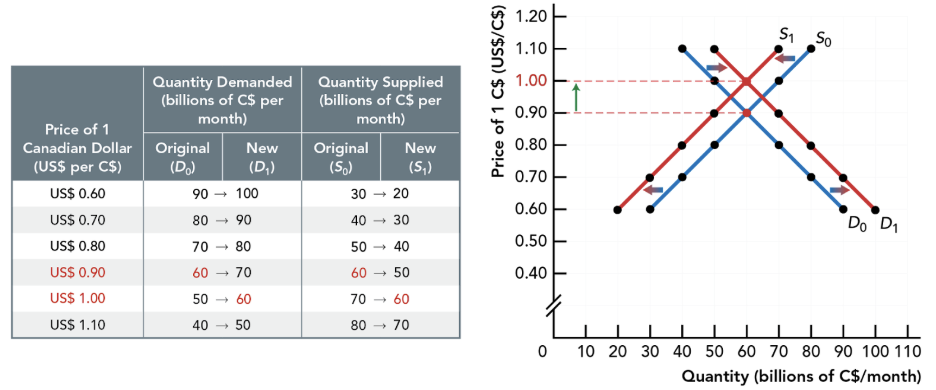

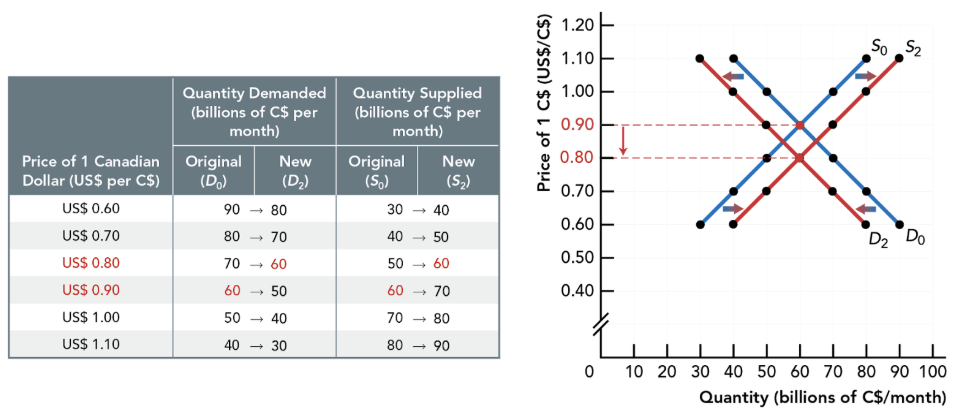

Law of Demand for Canadian Dollars

As exchange rate rises, quantity demanded of C$ decreases (inverse relationship)

With higher value of C$:

R.O.W. buys less

Quantity demanded for C$ decreases

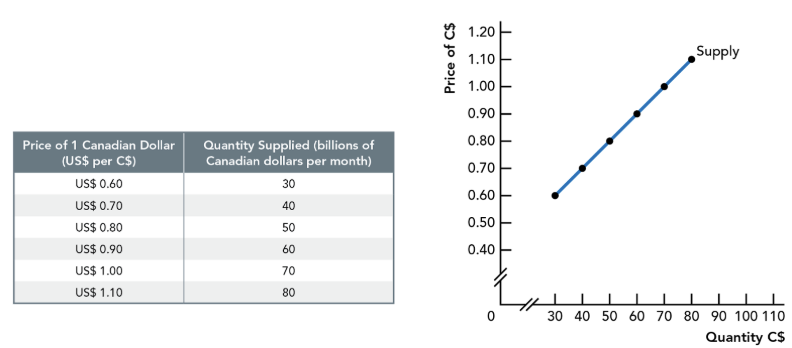

Law of Supply for Canadian Dollars

As exchange rate rises, quantity supplied of C$ increases (direct relationship)

With higher value of C$:

R.O.W imports and assets less expensive for Canadians, so Canadians buy more of them

To buy more R.O.W imports and assets, Canadians demand more foreign currency, so quantity supplied of C$ increases

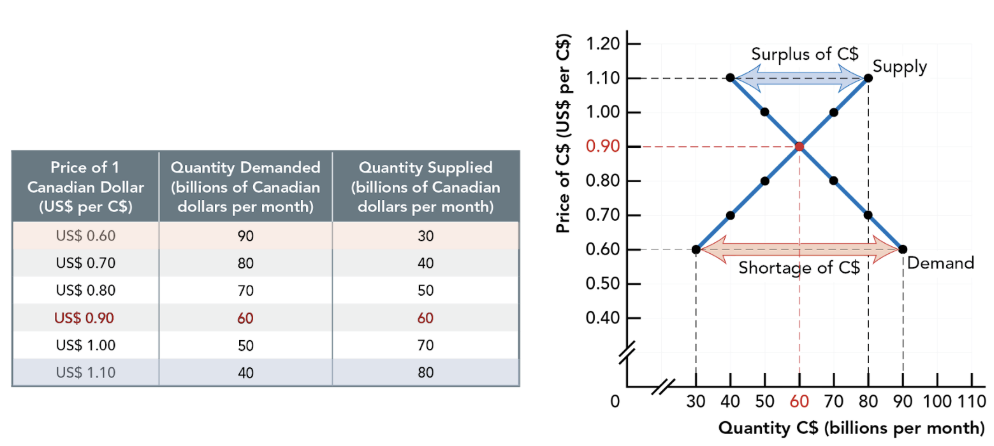

Foreign Exchange Market for Canadian Dollars

At equilibrium exchange rate: quantity demanded = quantity supplied of C$

Below equilibrium exchange rate: quantity demanded > quantity supplied — excess demand (shortages) for C$, buyers competition causes exchange rate to rise

Above equilibrium exchange rate: quantity demanded < quantity supplied — excess supply (surpluses) for C$, buyers competition causes exchange rate to fall

Supply of one currency is demand for another currency

Americans demanding C$ supply US$ in exchange

Canadians demanding US$ supply C$ in exchange

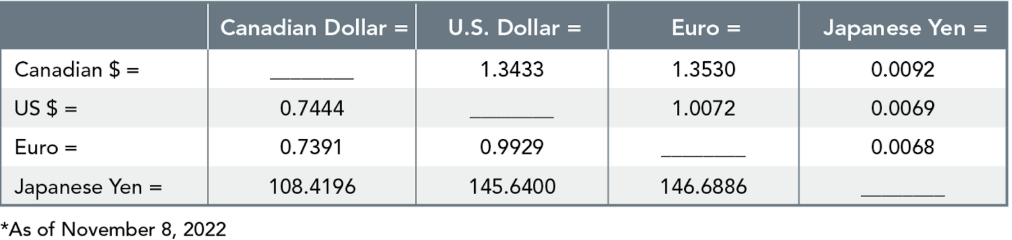

Reciprocal Exchange Rate

Divide 1 by the other exchange rate

Ex. if C$1.00 = US$0.90, reciprocal exchange rate is US$1.00 = 1/0.90 = C$1.11

It takes C$1.11 to buy US $1.00

When C$ appreciates against any currency, the currency depreciates against C$, and vice-versa

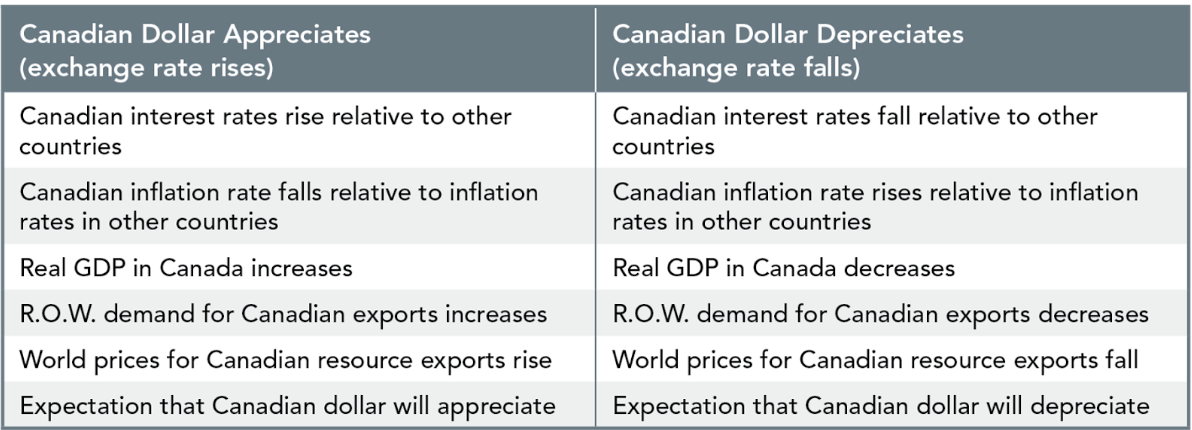

Interest Rate Differential

Difference in interest rates between countries

Increase in Canadian interest rate differential causes C$ to appreciate (increases demand and decreases supply of C$)

Decrease in Canadian interest has opposite effect

Inflation Rate Differential

Difference in inflation rates between countries

Increase in Canadian inflation rate differential causes C$ to depreciate (decreases demand and supply of C$)

Decrease in Canadian interest has opposite effect

Effects of increasing real GDP on C$

Increased investor confidence causes strong appreciation

Net effect is C$ appreciates

Solo changes in demand fir C$

Increasing R.O.W demand for Canadian exports causes slight appreciation of C$ (increases demand for C$)

Rising world prices for Canadian resource exports causes C$ to appreciate relative to currencies of non-resource producing countries (increases demand for C$)

Currency speculators are the most important force for…

Fluctuations of foreign exchange rates

Daily value world goods trade 2022 = US$68 billion

Daily value foreign currency exchange 2022 = US$8 trillion

Expected rise in future price of the C$ causes appreciation of C$ (increases demand for C$)

Speculators reinforce and speed up effects of other forces on the price of C$

Forces Changing the Price of the Canadian Dollar

International Transmission Mechanism

How exchange rate affect real GDP and inflation

Appreciating C$

Negative aggregate demand shock

Decreases net exports

Decreasing aggregate demand

Decreasing real GDP

Increasing unemployment

Causes disinflation

Pushes economy into a contractions

Puts downward pressure on the Canadian price level

Depreciating C$

Positive aggregate demand shock

Increases net exports

Increasing aggregate demand

Increasing real GDP

Decreasing unemployment

Increases inflation

Pushes the economy into an expansion

Puts upward pressure on the Canadian price level

Advantages and disadvantages to both higher and lower exchange rates

Appreciating C$

Makes imports less expensive

But a negative demand shock

Hurts exporters/exports decrease

Decrease real GDP

Increasing unemployment

Decreasing inflation

Depreciating C$

Makes imports more expensive

But a positive demand shock

Helps exporters/exports increase

Increasing real GDP

Decreasing unemployment

Increasing inflation

Law of One Price

Predictions where exchange rates settle

Profit seekers eliminate differences across markets in prices of same product

This is arbitrage — buying and selling of products (or funds) to profit from a difference in price

Purchasing Power Parity (PPP)

Exchange rates adjust so that money has equal purchasing power in any country

Does not account for trading limitations

Is the best available standard for judging exchange rates

Does not account for the role of speculators in influencing exchange rates

Ex. C$15 buys exactly the same products in Canada, and when converted into US$ at PP exchange rate, and in the United States

If purchasing power parity does NOT hold, for example, Canadian $ more valuable than US $ for some purchases

People sell C$ for US$ —> increase supply Canadian $

Canadian $ depreciates

When PP does not exist, profit-seeking forces and law of one price push exchange rate toward PPP rate

PPP does not account for trading limitations and role of speculators influencing exchange rates

Rate of Return Parity (Interest Rate Parity)

Rates of return on investments are equal across countries, accounting for expected depreciation or appreciation of exchange rates

Ex. Rate of Return in Japan = Rate of Return in Canada - Expected depreciation or appreciation of yen against C$

Floating Exchange Rate vs Fired Exchange Rate

Floating Exchange Rate: determined by demand and supply in foreign exchange market

Fixed Exchange Rate: determined by governments or central banks

Balance of Payments Accounts

Measure a country’s international transactions

Current account

Financial (capital account)

Statistical discrepancy

Flow of C$

On Balance of payments accounts

Into Canada are positive numbers

Out of Canada are negative numbers

Current Account

Measures flows of exports, imports (and net investment/labour/transfer income

Canadian exports create a positive inflow of C$

Imports create a negative outflow of C$

Deficit/negative balance when Canadian spending on imports fromR.O.W. > R.O.W. spending on Canadian exports

Surplus/positive balance when R.O.W. spending on Canadian exports > Canadian spending on imports from R.O.W.

Financial Account (Capital Account)

Measures international investments in financial assets like bonds and direct investment in buying business

Canadian investments in R.O.W. are negative outflows of C$

R.O.W. investments in Canada are positive inflow of C$

Deficit/negative balance when Canadian investments in R.O.W > R.O.W investments in Canada

Surplus/positive balance when R.O.W. investments in Canada > Canadian investments in R.O.W

Statistical Discrepancy

For missing data and errors; is not important for balance of payments

The balance of payments accounts must sum to zero (current account balance + financial account balance + statistical discrepancy = 0)

In the absence of statistical discrepancy, when there is a current account surplus, there is a financial account deficit, and vice-versa

When there is a current account surplus…

There is a financial account deficit

If R.O.W spends more on Canadian exports than Canadians spend on R.O.W imports, where does R.O.W. get extra C$?

From financial account deficit, with Canadians “loaning” R.O.W. extra C$ through investments

When there is current account deficit…

There is a financial account surplus

If Canada spends more on R.O.W. imports than R.O.W. spends on Canadian exports, where does Canada get extra foreign currency?