Intro To Macroeconomics Midterm 2 study Guide

1/41

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

42 Terms

Real GDP per capita

real GDP divided by the total population

Growth Rate

The percentage increase in real GDP per capita over a specific period.

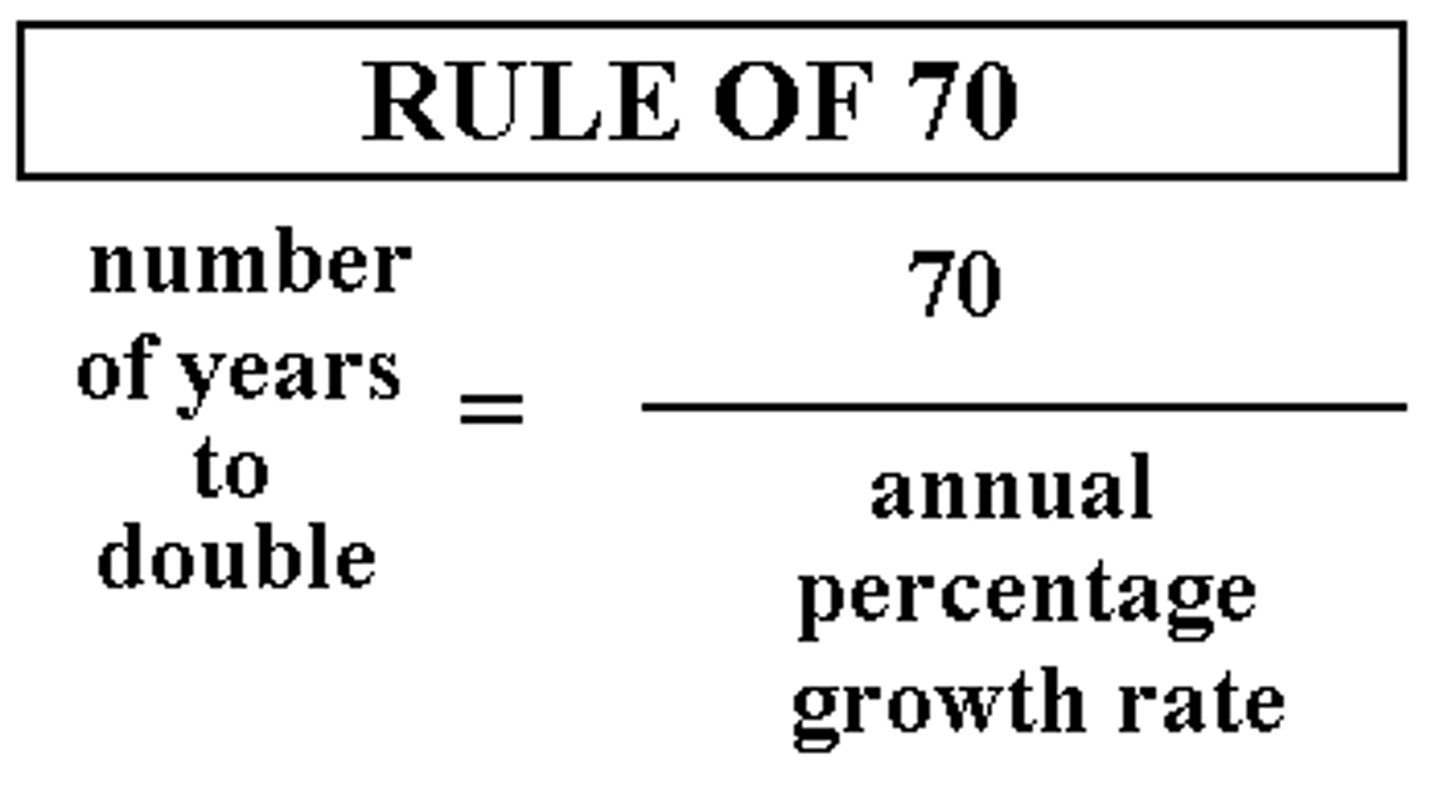

Rule of 70

A formula used to estimate the number of years required to double an economic variable, such as GDP, given a constant growth rate. Years to double = 70 / growth rate.

Technological Progress

Improvements in technology that increase productivity and efficiency in the economy.

Physical Capital

The tools, machinery, infrastructure, and equipment used in the production of goods and services.

Human Capital

The skills, knowledge, and experience possessed by individuals in an economy.

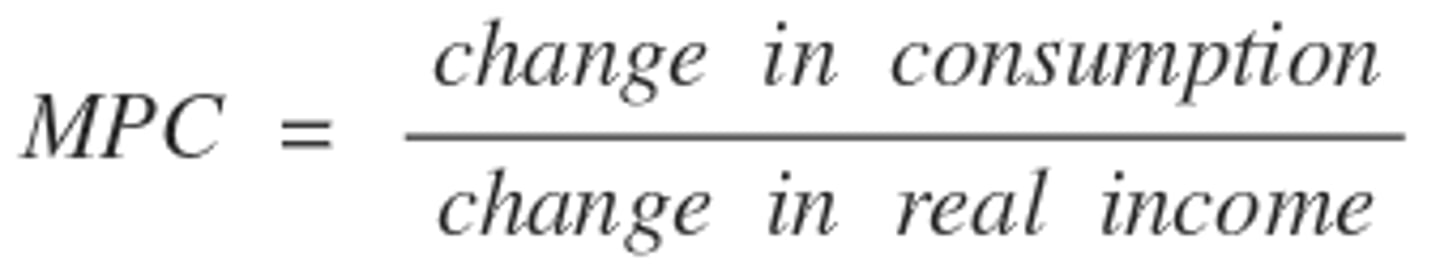

Marginal Propensity to Consume (MPC)

The fraction of additional income that is spent on consumption.

Investment Spending

Expenditures on physical capital such as machinery, buildings, and infrastructure

Market for Loanable Funds

A market in which savers supply funds for loans and borrowers demand funds.

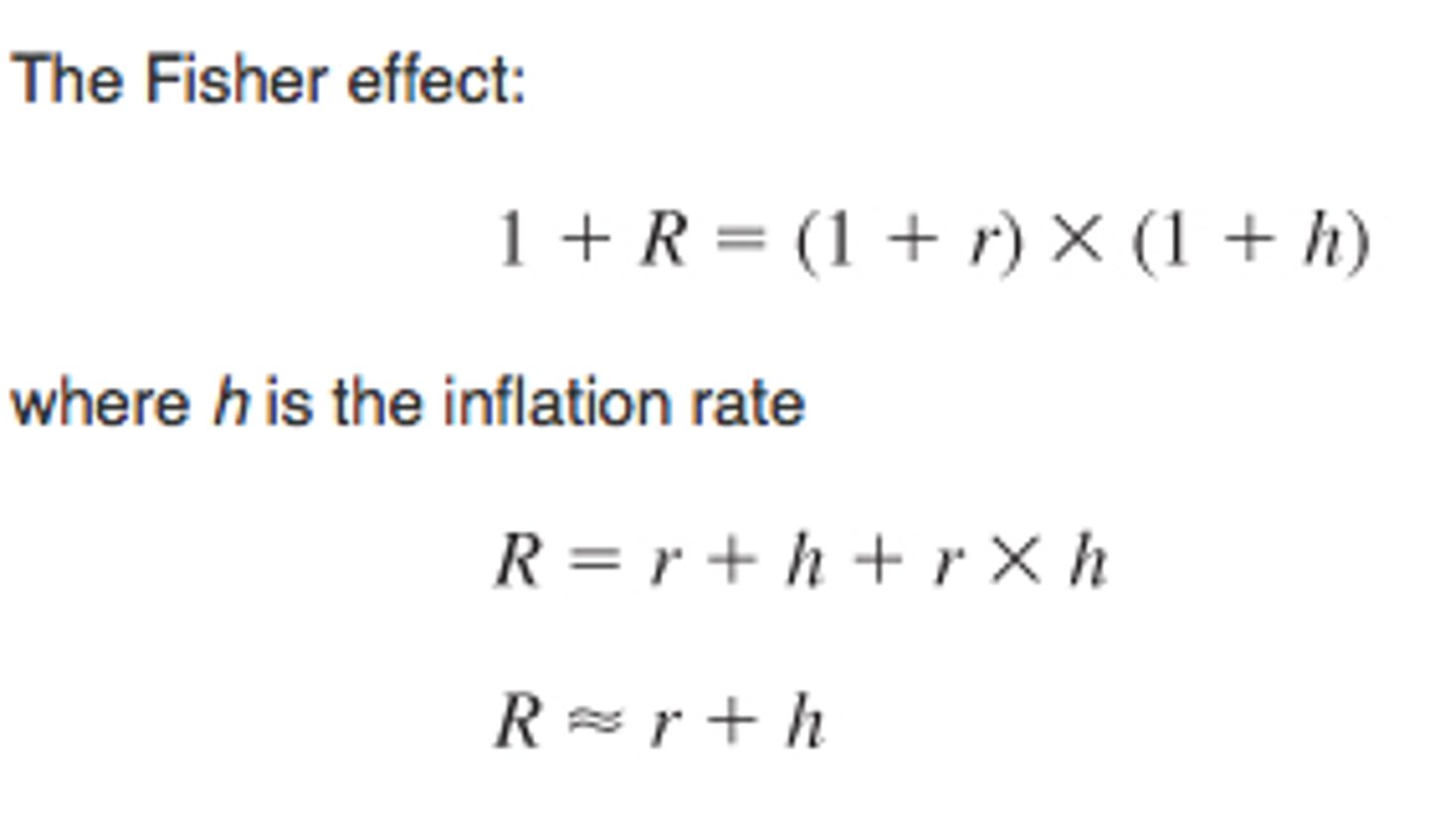

Nominal Interest Rate

The stated interest rate on a loan or investment without adjusting for inflation.

Real Interest Rate

The nominal interest rate adjusted for inflation.

Fisher Effect

The relationship between expected inflation and the nominal interest rate.

Federal Deficit

The amount by which government spending exceeds its revenue in a given year.

Infrastructure

Basic physical and organizational structures necessary for the operation of an economy (e.g., roads, bridges, electricity).

Unplanned Inventory Investment

The difference between the actual amount of goods produced and the amount sold, resulting in unintended changes in inventory.

Expenditure

Total spending in an economy, including consumption, investment, government spending, and net exports.

Spending Multiplier

The ratio of change in GDP to an initial change in spending.

GDP Deflator

A measure of the level of prices of all goods and services included in GDP.

Long-Run Economic Growth

The sustained increase in a country's output over time, driven by increases in productivity.

Inflation Rate

The percentage increase in the price level of goods and services over a period of time.

Aggregate Supply

The total supply of goods and services in an economy at a given overall price level and during a given period.

Aggregate Demand

The total demand for goods and services in an economy at a given overall price level and during a given period.

Capital Accumulation

The process of increasing the amount of capital in the economy through investment.

Diminishing Returns

A principle stating that as more capital is added to a fixed amount of labor, the additional output produced by each additional unit of capital will eventually decrease.

Nominal GDP

The total value of goods and services produced in an economy, unadjusted for inflation.

Unemployment Rate

The percentage of the labor force that is unemployed and actively seeking work.

What is a key input for measuring economic growth?

A) The size of the government's budget

B) Real GDP per capita

C) Life expectancy

D) The Dow Jones stock market index

B) Real GDP per capita

A nation's real GDP per capita increased from $250 billion to $275 billion in one year. Calculate the nation's growth rate.

Answer: 10% growth rate.

Calculation: [(275 - 250) / 250] * 100 = 10%

The three main reasons the average U.S. worker today produces far more than their counterpart a century ago are.

1. Technological progress

2. Physical capital accumulation

3. Human capital improvement

True or False: In 1798, the English economist Thomas Malthus predicted that a growing population and a fixed supply of land would eventually cause productivity to fall.

A) True

Economists say that long-run economic growth is almost entirely due to:

A) Rising productivity

B) Population growth

C) A democratically elected government

D) A balanced budget

A) Rising Productivity

How much sooner will the country in the south (with a 5% growth rate) double its GDP per capita compared to the country in the north (with a 2% growth rate)?

Using the Rule of 70:

For the south: 70 / 5 = 14 years

For the north: 70 / 2 = 35 years

Difference: 35 - 14 = 21 years

Answer: 21 years sooner.

When the government invests in building roads, ports, and a reliable power grid, it is investing in a nation's:

A) Private property

B) Human capital

C) Technological progress

D) Infrastructure

D) Infastructure

If the federal deficit is growing, what happens in the market for loanable funds?

An increase in the deficit will increase demand for loanable funds, shifting the demand curve to the right. This leads to a higher equilibrium interest rate and a higher equilibrium quantity of loanable funds.

What does the Fisher effect tell us about the relationship between inflation expectations and the market for loanable funds?

The Fisher effect indicates that nominal interest rates adjust to reflect changes in expected inflation. If inflation expectations increase, nominal interest rates will also rise.

If the nominal interest rate is 8.5% and the real interest rate is 6%, with inflation at 3.5%, how does this affect the borrower and lender?

Borrower: Will benefit because the actual inflation is higher than expected, reducing the real burden of the loan.

Lender: Will be hurt because the real interest rate (adjusted for inflation) is lower than expected.

Investment spending in macroeconomics refers to:

A) Buying stocks

B) Buying newly issued shares of stock

C) Adding to physical capital

D) Adding to one's retirement account

C) Adding to physical capital

If the interest rate is 5% and investors wish to borrow $100 million but savers wish to save $125 million at this rate, what happens to the interest rate?

There is a surplus of loanable funds. The interest rate will fall to restore equilibrium.

If the interest rate is 5% and investors wish to borrow $100 million but savers wish to save $125 million at this rate, what happens to the interest rate?

Spending multiplier = 1 / (1 - MPC) = 1 / (1 - 0.80) = 5

GDP increase = $10 million * 5 = $50 million

Using the table above, calculate the marginal propensity to consume (MPC) and the spending multiplier.

MPC = Change in consumption / Change in income

Spending multiplier = 1 / (1 - MPC)

True or false: Inventories are counted as investment because inventories are a source of future sales.

A) True

True or false: If real GDP is greater than planned expenditure, unplanned inventory investment is negative.

B) False