Institutions Ch 11 (Done)

1/81

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

82 Terms

Commercial banks

________________ are the largest group of financial institutions in terms of the dollar value of assets

depository institutions

Also called _____________________ because a significant proportion of their funds come from customer deposits

loans | deposits

Major assets are ______ (financial assets), and major liabilities are ________

Perform services essential to U.S. financial markets

Play a key role in the transmission of monetary policy

Provide payment services

Offer maturity intermediation services

disruption

Banks are regulated to protect against a __________ in the provision of these services and the cost this would impose on the economy and society at large

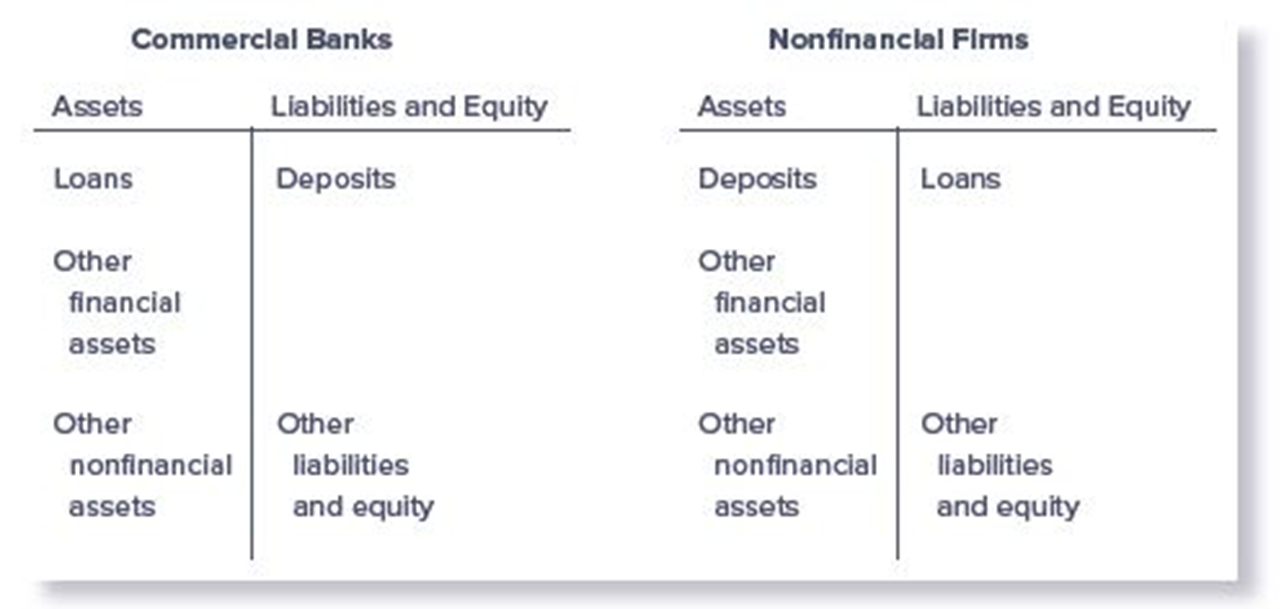

Differences in Balance Sheets of Commercial Banks and Nonfinancial Firms

loans

Majority of the assets held by commercial banks are ______

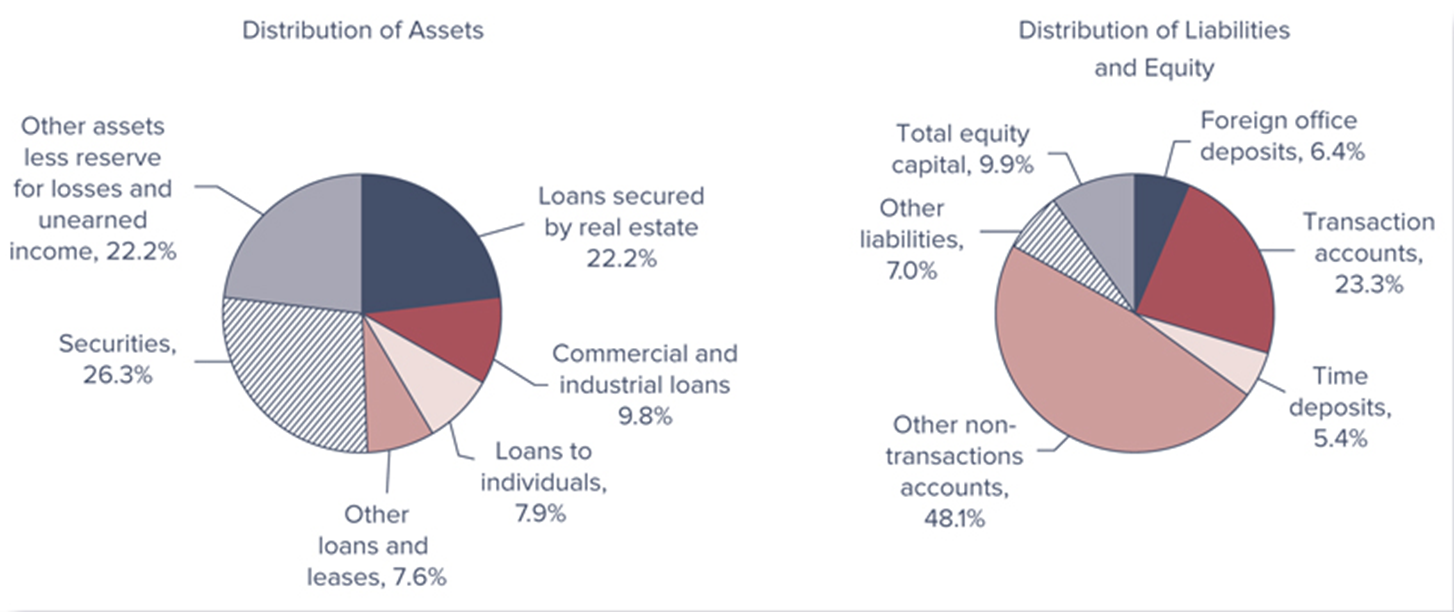

In 2021, net loans and leases amounted 46.7% of total assets

Bank premises and fixed assets, other real estate owned, intangible assets, and all other assets

___________________________________________________________________________________ amounted to 27.0% of total assets in 2021

Investment securities

___________________ generate interest income and provide banks with liquidity

Investment securities generate interest income and provide banks with liquidity

Include interest-bearing deposits purchased from other FIs, federal funds sold to other banks, repurchase agreements, U.S. Treasury and agency securities, municipal securities issued by states and political subdivisions, mortgage-backed securities, and other debt and equity securities

In 2021, the investment portfolio totaled 26.3% of total assets

Distribution of Commercial Bank Assets, Liabilities, and Equity, 2021

Commercial banks face unique risks because of their asset structure:

Credit (i.e., default) risk is the risk that promised cash flows from loans and securities held by FIs may not be paid in full

Liquidity risk is the risk that a sudden and unexpected increase in liability withdrawals may require an FI to liquidate assets in a very short period of time and at low prices

Interest rate risk is the risk incurred by an FI when the maturities of its assets and liabilities are mismatched and interest rates are volatile

Credit, liquidity, and interest rate risk all contribute to a commercial bank’s level of insolvency risk, the risk that an FI may not have enough capital to offset a sudden decline in the value of its assets relative to its liabilities

Credit (i.e., default) risk

______________________ is the risk that promised cash flows from loans and securities held by FIs may not be paid in full

Liquidity risk

______________ is the risk that a sudden and unexpected increase in liability withdrawals may require an FI to liquidate assets in a very short period of time and at low prices

Interest rate risk

________________ is the risk incurred by an FI when the maturities of its assets and liabilities are mismatched and interest rates are volatile

insolvency risk

Credit, liquidity, and interest rate risk all contribute to a commercial bank’s level of _____________, the risk that an FI may not have enough capital to offset a sudden decline in the value of its assets relative to its liabilities

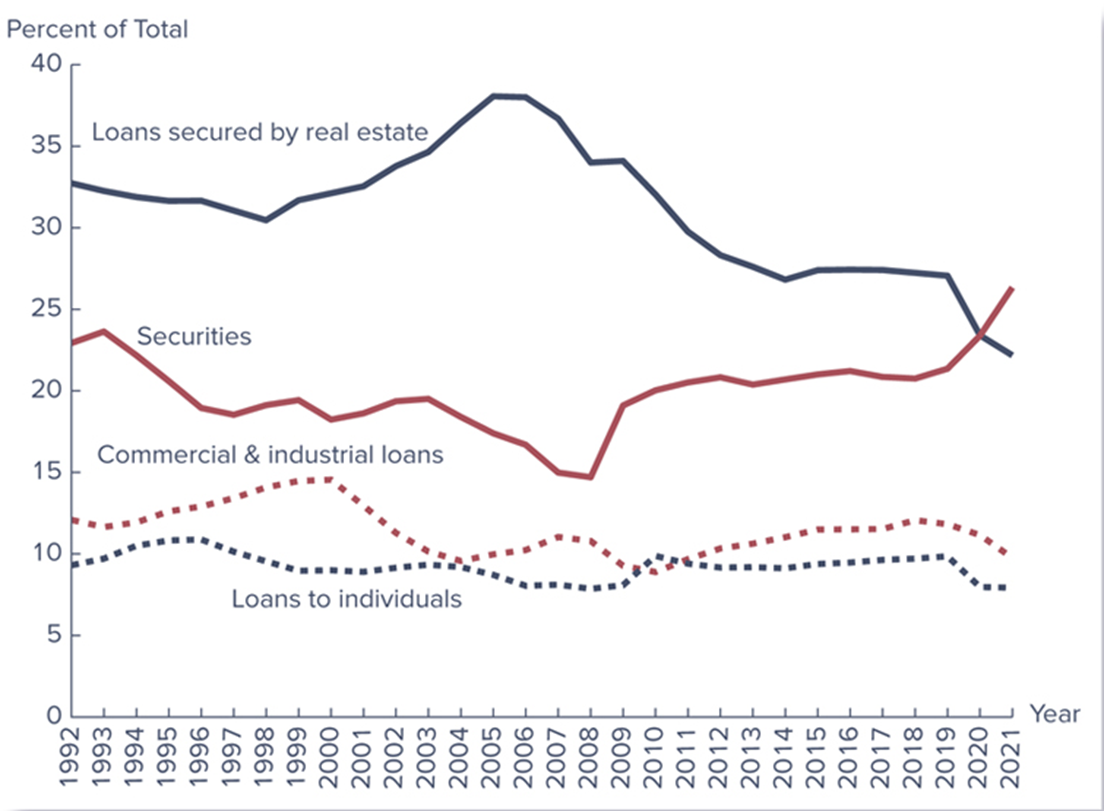

Loans and investment securities continue to be the primary assets of the banking industry

Loans secured by real estate have consistently been the largest asset class for commercial banks over the 1992–2019 period, but real estate loans have been shrinking steadily from 2007 to 2014

In 2016, the volume of 1–4 family mortgages originated by nonbanks surpassed the volume originated by banks

Nonbanks accounted for 52.5 percent of the volume of 1–4 family mortgages originated in 2017, up significantly from the financial crisis-era low of 23.5 percent in 2007

declining

Proportion of commercial and industrial loans have been _________ since 2000

Portfolio Shift: U.S. Commercial Banks’ Financial Assets

Commercial Bank Liabilities: Deposits

Transaction accounts are checkable deposits that are either demand deposits or NOW accounts

Transaction accounts are about 28.0% of total deposits

Interest-bearing checking accounts are called negotiable order of withdrawal (NOW) accounts

Household savings and time deposits (normally individual account holdings of less than $100,000)

Important components of bank retail savings accounts are small nontransaction accounts, which include passbook savings accounts and retail time deposits

Large time deposits ($100,000 or more)

Primarily made up of negotiable CDs, fixed-maturity interest-bearing deposits with face values of $100,000 or more that can be resold in the secondary market

Transaction accounts are checkable deposits that are either demand deposits or NOW accounts

Transaction accounts are about 28.0% of total deposits

Interest-bearing checking accounts are called negotiable order of withdrawal (NOW) accounts

Transaction accounts

___________________ are checkable deposits that are either demand deposits or NOW accounts

negotiable order of withdrawal (NOW) accounts

Interest-bearing checking accounts are called __________________________________

Household savings and time deposits (normally individual account holdings of less than $100,000)

Important components of bank retail savings accounts are small nontransaction accounts, which include passbook savings accounts and retail time deposits

Large time deposits ($100,000 or more)

Primarily made up of negotiable CDs, fixed-maturity interest-bearing deposits with face values of $100,000 or more that can be resold in the secondary market

negotiable CDs

Primarily made up of ____________ , fixed-maturity interest-bearing deposits with face values of $100,000 or more that can be resold in the secondary market

Nondeposit liabilities include a broad array of instruments:

Shorter maturity instruments

Purchase of federal funds (bank reserves) on the interbank market

Repurchase agreements (temporary swaps of securities for federal funds)

Longer maturity instruments

Issuance of notes and bonds

Shorter maturity instruments

Purchase of federal funds (bank reserves) on the interbank market

Repurchase agreements (temporary swaps of securities for federal funds)

Longer maturity instruments

Issuance of notes and bonds

shorter maturity structure

Liability structure of banks’ balance sheets tends to reflect _________________ than that of their asset portfolio

Relatively more liquid instruments, such as deposits and interbank borrowings, are used to fund relatively less liquid assets, such as loans

Interest rate risk—or maturity mismatch risk—and liquidity risk are key exposure concerns for bank managers

Commercial bank equity capital consists mainly of common and preferred stock (listed at par value), surplus or additional paid-in capital, and retained earnings

Commercial bank equity capital was 9.9% of total liabilities and equity in 2021

Troubled Assets Relief Program (TARP)

Capital Purchase Program, part of _________________________________ , was intended to encourage U.S. FIs to build capital and increase flow of financing to U.S. businesses and consumers to support the U.S. economy

Largest banks subject to annual stress tests, designed to ensure that the banks are properly capitalized

2010 Wall Street Reform and Consumer Protection Act

Banks engage in many fee-related activities off the balance sheet, such as the following:

Issuing various types of guarantees (e.g., letters of credit)

Making future commitments to lend

Engaging in derivative transactions – futures, forwards, options, and swaps

Off-balance-sheet (OBS) assets

When an event occurs, this item moves onto asset side of balance sheet or income is realized on income statement

Off-balance-sheet (OBS) liabilities

When an event occurs, this item moves onto liability side of balance sheet or an expense is realized on income statement

“tax-avoidance”

Banks have both earnings and regulatory __________________ incentives to undertake OBS activities

Use of derivative contracts accelerated during 1992–2010 period; accounted for much of the growth in OBS activity

Notional value of OBS activities at commercial banks was $10,252.8b in 1992 compared to $4,593.0b of on-balance-sheet activities

By 2010, the notional value of OBS bank activities was $254,731.5b (compared to the $13,254.2b value of on-balance-sheet activities) before falling to $180,421.6b in 2019

At the heart of the financial crisis were losses from OBS mortgage-backed securities, created and held by FIs

Losses from the falling value of OBS securities reached over $1 trillion worldwide through 2009

TARP gave U.S. Treasury funds to buy “toxic” mortgages and other securities from FIs

Trust services are offered by only the largest banks

Trust department of a commercial bank holds and manages assets for individuals or corporations are offered by only the largest banks

Individual trusts represent about one-half of all trust assets managed by commercial banks

Pension fund assets are the second largest group of assets managed by trust departments of commercial banks

Trust services

______________ are offered by only the largest banks

Trust department of a commercial bank holds and manages assets for individuals or corporations are offered by only the largest banks

Individual trusts represent about one-half of all trust assets managed by commercial banks

Pension fund assets are the second largest group of assets managed by trust departments of commercial banks

Correspondent banking is the provision of banking services to other banks that do not have the staff resources to perform the services themselves

Services include check clearing and collection, foreign exchange trading, hedging services, and participation in large loan and security issuances

Correspondent banking

_____________________ is the provision of banking services to other banks that do not have the staff resources to perform the services themselves

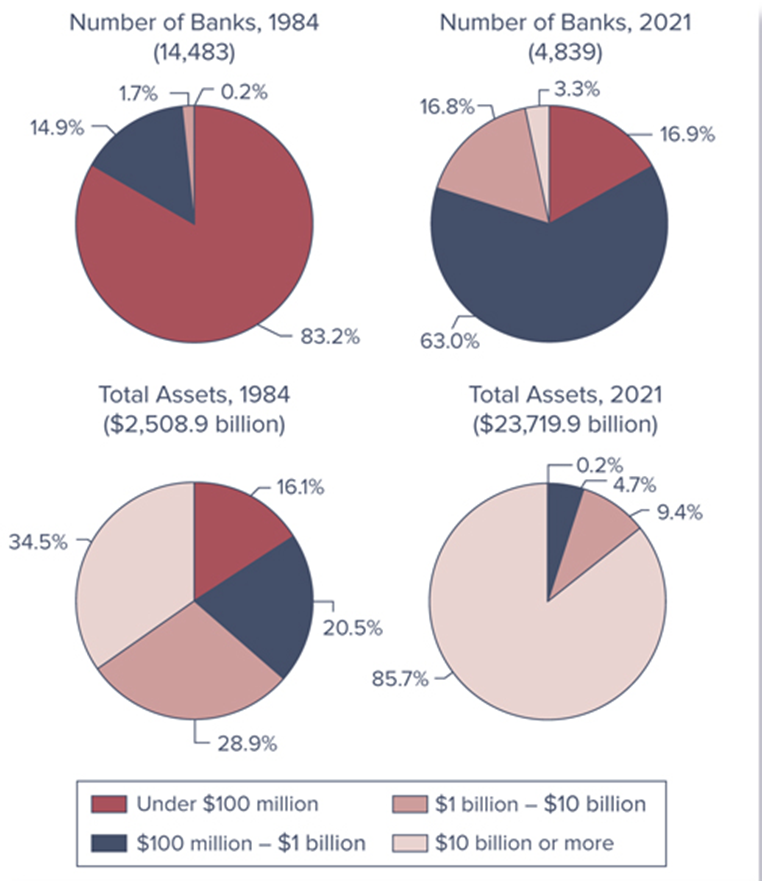

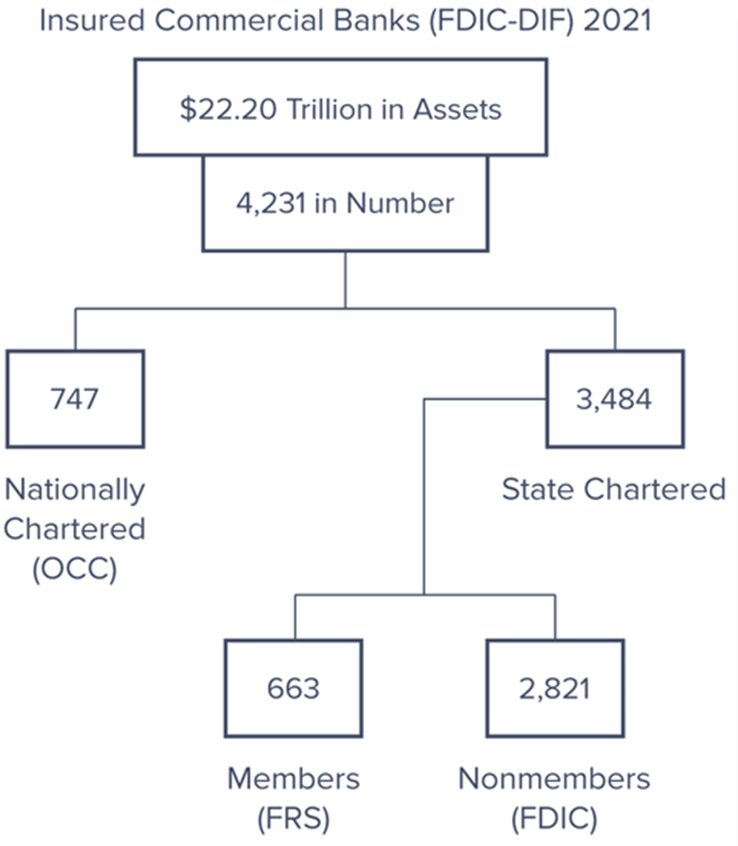

Number of commercial banks in U.S. has been declining, though much of this is due to mergers and acquisitions

2021 – 4,231 banks

1984 – 14,483 banks

It was not until the 1980s and 1990s that regulators allowed banks to merge with other banks across state lines (i.e., interstate mergers)

In 1994, Congress passed legislation (the Reigle-Neal Act) easing branching by banks across state lines

It has only been since 1987 that banks have possessed powers to underwrite corporate securities

Full authority to enter the investment banking (and insurance) business was received only with the passage of the Financial Services Modernization Act in 1999

Activities of nonfinancial service firms that perform banking services have been termed shadow banking

Shadow banking system intermediates the flow of funds between net savers and net borrowers

Credit intermediation is performed through a series of steps involving many nonbank financial service firms

Face significantly reduced regulation than traditional banks

Can often perform credit intermediation process more cost efficiently than traditional banks

shadow banking

Activities of nonfinancial service firms that perform banking services have been termed ______________

2010 Wall Street Reform and Consumer Protection Act

_____________________________________________ called for regulators to be given broad authority to monitor and regulate nonbank financial firms that pose risks to the financial system

Community banks have less than $1 billion in asset size and tend to specialize in retail banking

Retail banking is consumer-oriented banking, such as providing residential and consumer loans and accepting smaller deposits

Decreasing both in number and importance, as asset share has dropped from 36.6% in 1984 to 4.9% in 2021

Community banks

_________________ have less than $1 billion in asset size and tend to specialize in retail banking.

Retail banking

_________________ is consumer-oriented banking, such as providing residential and consumer loans and accepting smaller deposits

Relative asset share of largest banks (over $1 billion in size) increased from 63.4 percent in 1984 to 95.1 percent in 2021

Regional or superregional banks engage in a complete array of wholesale banking, or commercial-oriented, activities

Have access to the markets for purchased funds (e.g., interbank or federal funds market), to finance lending and investment activities

wholesale banking

Regional or superregional banks engage in a complete array of ________________, or commercial-oriented, activities

federal funds market

Have access to the markets for purchased funds (e.g., interbank or _________________), to finance lending and investment activities

Money center banks

__________________ engage heavily in wholesale activity in money markets, with retail banks and large firms as clients

U.S. Bank Asset Concentration, 1984 versus 2021

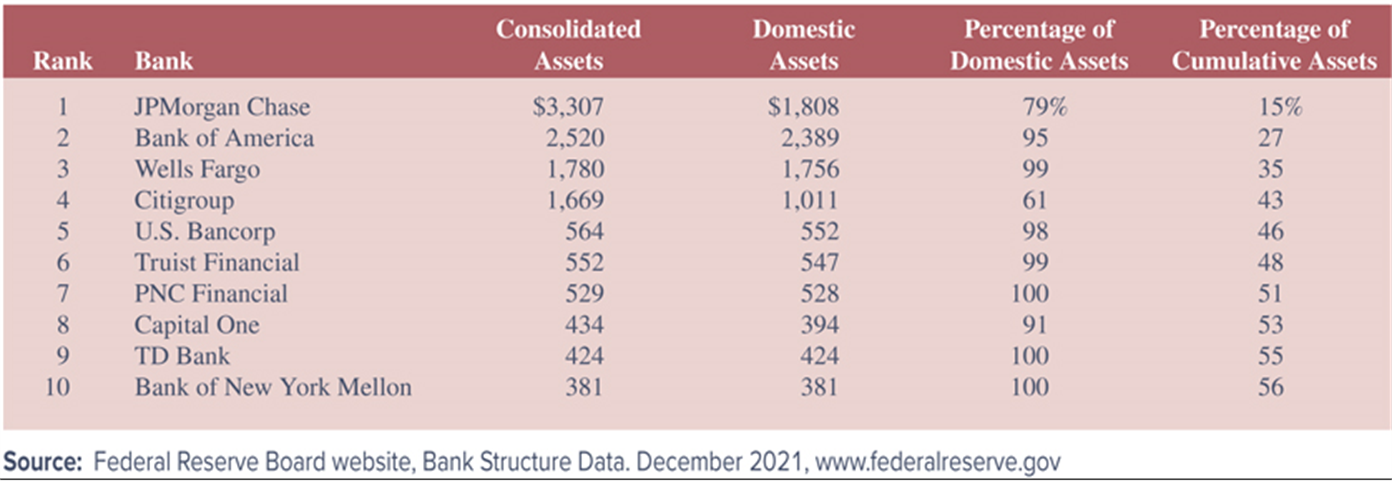

Top Ten U.S. Banks Listed by Total Assets, 2021 (in billions of dollars)

Size

_____ has traditionally affected the types of activities and financial performance of commercial banks

Small banks typically focus on the retail side

Generally hold fewer OBS assets and liabilities than large banks

Rarely hold derivative securities

More sheltered from competition in highly localized markets

Lend to smaller, less sophisticated customers than do large banks

Large banks usually engage in both retail and wholesale banking, but focus on the wholesale side of the business

Operate with lower amounts of equity capital than do small banks

Tend to use more purchased funds and have fewer core deposits

Lend to larger corporations, which means their interest rate spreads (i.e., the difference between their lending rates and deposit rates) and net interest margins (i.e., interest income minus interest expense divided by earning assets) have usually been narrower than those of smaller regional banks

Pay higher salaries and invest more in buildings and premises

Diversity their operations and services more than small banks

Generate more noninterest income than small banks

interest rate spreads | net interest margins

Lend to larger corporations, which means their ________________ (i.e., the difference between their lending rates and deposit rates) and ________________ (i.e., interest income minus interest expense divided by earning assets) have usually been narrower than those of smaller regional banks

Strong performance of commercial banks during early 2000s

Federal Reserve cut interest rates 13 times during this period

Lower interest rates made home purchasing more affordable

Development of new financial instruments helped banks shift credit risk from their balance sheets to financial markets and other FIs, such as insurance companies

Improved IT helped banks manage their risk better

Rising interest rates in mid-2000s caused performance to decline, but not significantly

Third quarter 2006 earnings represented the second highest quarterly total ever reported by the industry

Industry’s core capital ratio increased to 10.36%, the highest level since new, risk-based capital ratios were implemented in 1993

No FDIC-insured banks failed during 2005 or 2006

Performance deteriorated in late 2000s as U.S. economy experienced its strongest recession since Great Depression

For all of 2007, net income was $99.94 billion, a decline of $45.28 billion (31.1 percent) from 2006

Average ROA for 2007 was 0.81 percent, the lowest yearly average since 1991 and the first time in 15 years that the industry’s annual ROA had been below 1 percent

One in four institutions (25.0 percent) was unprofitable in 2008

Bank performance slowly recovered in 2010 – 2016

2010 industry ROA and ROE increased to 0.65% and 5.85%, respectively; by 2016, industry ROA and ROE increased to 1.04% and 9.27%, respectively

By the end of 2019, 96.4 percent of banks were profitable

ROA and ROE declined due to COVID-19 but fully recovered to pre-pandemic levels in 2021

U.S. banks may be subject to the supervision and regulations of as many as four separate regulators:

Federal Deposit Insurance Corporation (FDIC) was established in 1933 and insures deposits of commercial banks

Acts as receiver and liquidator when insured bank is closed

Manages the Depositors Insurance Fund, or DIF

Office of the Comptroller of the Currency (OCC) is the oldest U.S. bank regulatory agency, established in 1863

Primary function is to charter (and close) national banks

Federal Reserve System (FRS) serves as the country’s central bank, has regulatory power over some banks, and where relevant, their holding company parents

State bank regulators perform function similar to those the OCC performs, but only for state-chartered commercial banks

Federal Deposit Insurance Corporation (FDIC)

______________________________________ was established in 1933 and insures deposits of commercial banks

Acts as receiver and liquidator when insured bank is closed

Manages the Depositors Insurance Fund, or DIF

Office of the Comptroller of the Currency (OCC)

______________________________________ is the oldest U.S. bank regulatory agency, established in 1863

Primary function is to charter (and close) national banks

Federal Reserve System (FRS)

_________________________ serves as the country’s central bank, has regulatory power over some banks, and where relevant, their holding company parents

State bank regulators

___________________ perform function similar to those the OCC performs, but only for state-chartered commercial banks

Bank Regulators

Global Issues

Advantages of international expansion

Risk diversification

Economies of scale

Innovations

Funds source

Customer relationships

Regulatory avoidance

Disadvantages of international expansion

Information/monitoring costs

Nationalization/expropriation

Fixed costs

Advantages of international expansion

Risk diversification

Economies of scale

Innovations

Funds source

Customer relationships

Regulatory avoidance

Disadvantages of international expansion

Information/monitoring costs

Nationalization/expropriation

Fixed costs

The financial crisis of 2008-2009 spread worldwide and banks saw losses that were magnified by illiquid markets

Largest banks in the Netherlands, Switzerland, and the U.K. had net losses in 2008

Banks in Ireland, Spain, and the U.K. were especially hard hit because they had large investments in mortgages and mortgage-backed securities, both U.S. and domestic

central banks and national governments

Many European banks averted outright bankruptcy thanks to direct support from their __________________________________

Greece suffered a severe debt crisis in the spring of 2010

Problems from the Greek banking system then spread to other European nations, such as Portugal, Spain and Italy

The situation stabilized after 2012, but a major debt payment was due from Greece to creditors on June 30, 2015

Deal was reached that required Greece to surrender to all its creditors’ demands, including tax increases, pension reform, and the creation of a fund (under European supervision) with state-owned assets earmarked to be privatized or liquidated

European banking system was rocked again in June 2016 with “Brexit”

The EU and the UK Trade and Cooperation Agreement was signed on December 30, 2020, and entered into force on May 1, 2021