Chapter 19: Title to Goods and Risk of Loss

1/20

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

21 Terms

Introduction to Title to Goods and Risk of Loss

Common law placed the risk of loss to goods on the party who held title to the goods

Article 2 of the Uniform Commercial Code (UCC) rejects this notion and adopts concise rules for risk of loss that are not tied to title

Article 2A (Leases) of the UCC establishes rules regarding title and risk of loss for leased goods

Identification of Goods

Identification of goods is distinguishing goods named in a contract from the seller’s or lessor’s other goods

Can be made at any time and in any manner explicitly agreed to by the parties of a contract

In the absence of an agreement, the UCC mandates when identification occurs:

Already existing goods are identified when a contract is made and names the specific goods sold or leased

Examples A piece of farm machinery, a car, or a boat is identified when its serial number is listed on a sales or lease contract.

Goods that are part of a larger mass of goods are identified when the specific merchandise is designated

Example If a food processor contracts to purchase 150 cases of oranges from a farmer who has 1,000 cases of oranges, the buyer’s goods are identified when the seller explicitly separates or tags the 150 cases for that buyer.

Future goods are goods not yet in existence

Are identified when the goods are shipped, marked, or designated by the seller or lessor as the goods to which the contract refers

Passage of Title to Goods

Once the goods that are the subject of a contract exist and have been identified, title to the goods may be transferred from the seller to the buyer

Title is legal, tangible evidence of ownership of goods

If the parties do not agree to a specific time, title passes to the buyer when and where the seller’s performance with reference to the physical delivery is completed

Shipment and Destination Contracts

A shipment contract requires the seller to ship the goods to the buyer via a common carrier

The seller is required to (1) make proper shipping arrangements and (2) deliver the goods into the carrier’s hands

Title passes to the buyer at the time and place of shipment

A destination contract requires the seller to deliver the goods either to the buyer’s place of business or to another destination specified in the sales contract

Title passes to the buyer when the seller tenders delivery of the goods at the specified destination

Delivery of Goods without Moving Them

Sometimes a sales contract authorizes goods to be delivered without requiring the seller to move them

In other words, the buyer might be required to pick up goods from the seller

If the document of title or bill of lading is required, the title passes when the seller delivers the document

Document of title is the actual piece of paper that is required in some transactions of pickup and delivery

If (1) no document of title is needed, AND (2) the goods are identified at the time of contracting, title passes at the time and place of contracting

Commonly Used Shipping Terms

F.O.B. (free on board) point of shipment requires the seller to arrange to ship the goods and put the goods in the carrier’s possession

The buyer bears the shipping expense and risk of loss while the goods are in transit

F.A.S. (free alongside ship) port of shipment (F.A.S. (vessel) port of shipment) requires the seller to deliver and tender the goods alongside the named vessel or on the dock designated and provided by the buyer

The seller bears the expense and risk of loss until this is done

The buyer bears shipping costs and the risk of loss during transport

C.I.F. (cost, insurance, and freight) is a pricing term that means that the price includes the cost of the goods and the costs of insurance and freight

C.&F. (cost and freight) is a pricing term that means that the price includes the cost of the goods and the cost of freight

In both cases, the seller must, at his or her own expense and risk, put the goods into the possession of a carrier

The buyer bears the risk of loss during transportation

F.O.B. (free on board) place of destination requires the seller to bear the expense and risk of loss until the goods are tendered to the buyer at the place of destination

Ex-ship (from the carrying vessel) requires the seller to bear the expense and risk of loss until the goods are unloaded from the ship at its port of destination

No-arrival, no-sale contract requires the seller to bear the expense and risk of loss of the goods during transportation

However, the seller is under no duty to deliver replacement goods to the buyer because there is no contractual stipulation that the goods will arrive at the appointed destination

Risk of Loss – No Breach of the Sales Contract

In the case of sales contracts, common law placed the risk of loss of goods on the party who had title to the goods

Article 2 of the UCC rejects this notion and allows the parties to a sales contract to agree among them who will bear the risk of loss if the goods subject to the contract are lost or destroyed

If the parties do not have a specific agreement concerning the assessment of the risk of loss, the UCC mandates who will bear the risk

Carrier Cases: Movement of Goods [No Breach of the Sales Contract]

Unless otherwise agreed, goods that are shipped via carrier (e.g., railroad, ship, truck) are considered to be sent pursuant to a shipment contract or a destination contract

Absent any indication to the contrary, sales contracts are presumed to be shipment contracts rather than destination contracts

Shipment Contract

A shipment contract requires the seller to deliver goods conforming to the contract to a carrier

Risk of loss in a shipment contract is a situation in which the buyer bears the risk of loss during transportation

F.O.B. point of shipment

Destination Contract

A destination contract requires the seller to deliver conforming goods to a specific destination

Risk of loss in a destination contract is a situation in which the seller bears the risk of loss during transportation

The buyer does not have to pay for destroyed goods

The risk of loss does not pass until the goods are tendered to the buyer at the specified destination

F.O.B. place of destination

Noncarrier Cases: No Movement of Goods [No Breach of the Sales Contract]

Sometimes a sales contract stipulates that the buyer is to pick up the goods at either the seller’s place of business or another specified location

Merchant-Seller

If the seller is a merchant, the risk of loss does not pass to the buyer until the goods are received

In other words, a merchant-seller bears the risk of loss between the time of contracting and the time the buyer picks up the goods

Nonmerchant-Seller

Nonmerchant-sellers pass the risk of loss to the buyer on “tender of delivery” of the goods.

Tender of delivery occurs when the seller (1) places or holds the goods available for the buyer to take delivery and (2) notifies the buyer of this fact

Goods in the Possession of a Bailee [No Breach of the Sales Contract]

Goods sold by a seller to a buyer are sometimes in the possession of a bailee, the holder of goods who is not a seller or a buyer

If goods are to be delivered to the buyer without the seller moving them, the risk of loss passes to the buyer when:

The buyer receives negotiable document of title, OR

The bailee acknowledges buyer’s right to possession, OR

The buyer receives a nonnegotiable document of title and has reasonable time to present the document or direction to the bailee and demand the goods

If the bailee refuses to honor the document or direction, the risk of loss remains on the seller

Risk of Loss – Breach of the Sales Contract

Seller in Breach of a Sales Contract

Seller breaches a sales contract if he or she tenders or delivers nonconforming goods to the buyer

If the goods are so nonconforming that the buyer has the right to reject them, the risk of loss remains on the seller until (1) the defect or nonconformity is cured or (2) the buyer accepts the nonconforming goods

Example A buyer orders 1,000 talking dolls from a seller. The contract is a shipment contract, which normally places the risk of loss during transportation on the buyer. However, the seller ships to the buyer totally nonconforming dolls that cannot talk. This switches the risk of loss to the seller during transit. The goods are destroyed in transit. The seller bears the risk of loss because he breached the contract by shipping nonconforming goods.

Buyer in Breach of a Sales Contract

A buyer breaches a sales contract if he or she

Refuses to take delivery of conforming goods, OR

Repudiates the contract, OR

Breaches the contract

A buyer who breaches a sales contract before the risk of loss would normally pass to him or her bears the risk of loss of any goods identified to the contract

The risk of loss rests on the buyer for only a commercially reasonable time

The buyer is liable only for any loss in excess of insurance recovered by the seller

Risk of Loss in Conditional Sales

A conditional sale is a sale of goods where the seller entrusts possession of goods to a buyer on a trial basis

These transactions are classified as sales on approval, sales or returns, and consignment transactions

Sale on Approval

In a sale on approval, there is no actual sale occurs until the buyer accepts the goods

Sale on approval occurs when a merchant allows a customer to take the goods for a specified period of time to see if they fit the customer’s needs

The prospective buyer may use the goods to try them out during this time

In a sale on approval, the risk of loss and title to the goods remain with the seller

They do not pass to the buyer until acceptance

Risk of loss and title pass when the goods are accepted by the buyer

Acceptance of the goods occurs if the buyer:

Expressly indicates acceptance, OR

Fails to notify the seller of rejection of the goods within the agreed-on trial period (or, if no time is agreed on, within a reasonable time), OR

Uses the goods inconsistently with the purpose of a trial period

Sale or Return

In a sale or return contract, the seller delivers goods to a buyer with the understanding that the buyer may return the goods if they are not used or resold within a stated or reasonable period of time

The sale is considered final if the buyer fails to return the goods within the specified time or within a reasonable time, if no time is specified

The buyer has the option of returning all the goods or any commercial unit of the goods

Risk of loss and title pass to buyer when buyer has possession of goods

Goods sold pursuant to a sale or return contract are subject to the claims of the buyer’s creditors while the goods are in the buyer’s possession

Consignment

In a consignment, a seller (the consignor) delivers goods to a buyer (the consignee) to sell on his or her behalf

The consignee is paid a fee if it sells the goods on behalf of the consignor

A consignment is treated as a sale or return under the UCC; that is, title and risk of loss of the goods pass to the consignee when the consignee takes possession of the goods

Risk of Loss in Lease Contracts

The lessor and the lessee may agree about who will bear the risk of loss of the goods if they are lost or destroyed

If the parties do not agree, the UCC provides the following risk of loss rules:

In the case of an ordinary lease, if the lessor is a merchant, the risk of loss passes to the lessee on the receipt of the goods

An ordinary lease is a lease of goods by a lessor to a lessee

If the lease is a finance lease and the supplier is a merchant, the risk of loss passes to the lessee on the receipt of the goods

A finance lease is a three-party transaction consisting of a lessor, a lessee, and a supplier (or vendor)

If a tender of delivery of goods fails to conform to the lease contract, the risk of loss remains with the lessor or supplier until cure or acceptance

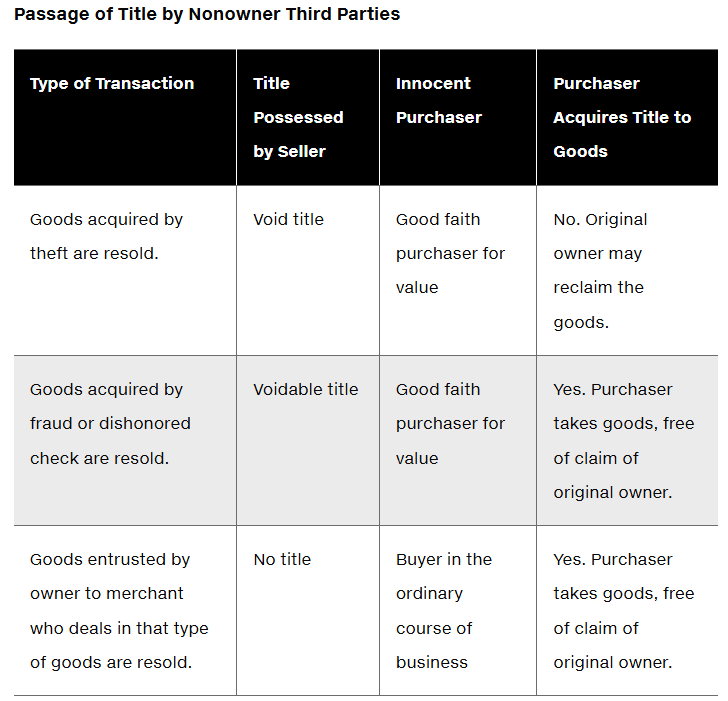

Sale of Goods by Nonowners

Sometimes people sell goods even though they do not hold valid title to them

The UCC anticipated many of the problems this situation could cause and established rules concerning the title, if any, that could be transferred to purchasers

Types:

Stolen Goods

Fraudulently Obtained Goods

Entrustment Rule

Stolen Goods

In a case in which a buyer purchases goods or a lessee leases goods from a thief who has stolen them, the purchaser does not acquire title to the goods, and the lessee does not acquire any leasehold interest in the goods

Buyer has

voidtitle / leasehold interest

The real owner can reclaim the goods from the purchaser or lessee

Fraudulently Obtained Good

A sellor or lessor has voidable title / leasehold interest to goods if he or she obtained the goods through

Fraud, OR

If the check for the payment of the goods or lease is dishonored, OR

If the seller or lessor impersonated another person

A person with voidable title to goods can transfer good title to a good faith purchaser for value or a good leasehold interest to a good faith subsequent lessee

A good faith purchaser or lessee for value is someone who pays sufficient consideration or rent for the goods to the person he or she honestly believes has good title to or leasehold interest in those goods

The real owner cannot reclaim goods from such a purchaser or lessee

Entrustment Rule

The entrustment rule is a rule that states that if the owner of goods entrusts the possession of these goods to a merchant who deals in goods of that kind (e.g., for repair or consignment), the merchant has the power to transfer all rights (including title) in the goods to a buyer in the ordinary course of business

The real owner cannot reclaim the goods from this buyer

The entrustment rule also applies to leases

Case 19.1 Entrustment Rule

Case

Lindholm v. Brant

S.C. Ct. of Connecticut, 925 A.2d 1048 (2007)

Facts

An owner of a famous piece of art entrusted the art to a art dealer who subsequently sold it to Brant

Issue

Is Brant a buyer in the ordinary course of business who has a claim of ownership to Red Elvis that is superior to that of the owner Lindholm?

Decision

The trial court held that Brant was a buyer in the ordinary course of business who obtained ownership to Red Elvis when he purchased the stolen Red Elvis from Malmberg

Lindholm appealed the decision of the trial court to the supreme court of Connecticut, which affirmed the decision of the trial court and awarded the Red Elvis to Brant

A court in Sweden convicted Malmberg of criminal fraud and sentenced him to three years in prison. A Swedish court awarded Lindholm $4.6 million in damages against Malmberg

United Nations Convention on Contracts for the International Sale of Goods (CISG)

The United Nations Convention on Contracts for the International Sale of Goods (CISG) is a model act for international sales contracts that provides legal rules that govern the formation, performance, and enforcement of international sales contracts entered into:

Between businesses located in different countries that are signatories of the CISG, or

To sales contracts not otherwise subject to the CISG if the parties select in their contract to be governed by the CISG

Many provisions in the CISG are similar to the UCC; however, under the CISG

Acceptance does not occur until receipt (UCC uses the mailbox rule)

There is no writing requirement for the sale of goods (UCC requires writings for the sale of goods of $500 or more)

Additional terms or terms that modifications in acceptance are treated as rejections and counteroffers—no contract is formed (the UCC, in most cases, includes additional terms and and knocks out conflicting terms—contracts are formed)