Microecon exam 22-25

1/83

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

84 Terms

Market Structure

environment that influences output and pricing

perfect competition

A theory of market structure based on four assumptions: (1) There are many sellers and buyers

(2) the sellers sell a homogeneous good

(3) buyers and sellers have all relevant information

(4) entry into, and exit from, the market is easy.

(Demand curve is perfectly inelastic (horizontal))

public franchise

A firm’s government-granted right that permits the firm to provide a particular good or service and that excludes all others from doing so. (Think patents)

Natural monopoly

The condition in which economies of scale are so pronounced that only one firm can survive.

price searcher

A seller that has the ability to control, to some degree, the price of the product it sells.

Monopolists view

P > MR, P > MC, Price searcher

price taker

A seller that does not have the ability to control the price of the product it sells; the seller “takes” the price determined in the market.

Homogeneous product

essentially raw materials (cannot be more than one type)

Marginal revenue

change in TR resulting from sale of 1+ outputs (think change in revenue)

law of diminishing marginal returns

Marginal cost curve goes up and market supply goes up

profit maximization rule

Quantity of Output which MR = MC

Marginal Revenue =

Ch in TR / Ch in Q

P = MC and Qd = MR

Only for a perfectly competitive firm

What are the steps to find price

Equate MR = MC

Compare Price to ATC

a. ATC < Price = profit

b. If ATC > price then go to 3

If loss then compare to AVC

a. Price > AVC = Good

b. Price < AVC = BAD

Resource allocative efficiency

output is at P = MC

Total revenue =

Price * Quantity

Total Cost =

Average Total Cost * Quantity

Total Variable Cost =

Average Variable Cost * Quantity

Profit =

Total Revenue - Total Costs

Total Revenue - (TVC + TFC)

Total Revenue - TFC

Should a perfectly competitive firm shutdown?

P > AVC → Firm produces

P < AVC → Firm shuts down

TR > TVC → Firm produces

TR < TVC → Firm shuts down

short-run (firm) supply curve

The portion of the firm’s marginal cost curve that lies above the average variable cost curve.

short-run market (industry) supply curve

The horizontal sum of all existing firms’ short-run supply curves.

Market supply curves are ____ sloping

upward

Long run competitive equilibrium

P = MC = SRATC = LRATC

Rise in Market demand = change in Equilibrium

Economic profit

should always be zero

when ATC and Price meet = zero

P = SRATC

productive efficiency

lowest ATC

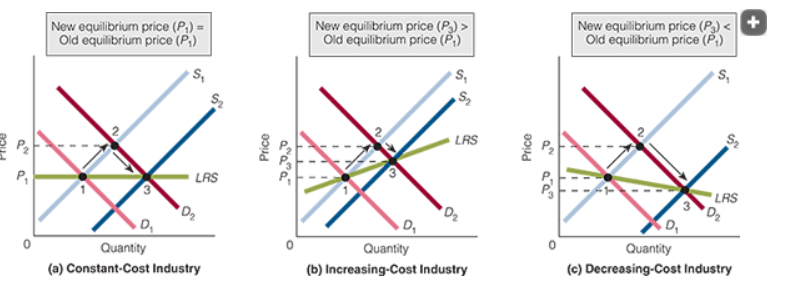

Long Run Industry supply curves

A graphic representation of the quantities of output that an industry is prepared to supply at different prices after the entry and exit of firms are completed.

Increasing cost industry

An industry in which average total costs increase as output increases and decrease as output decreases when firms enter and exit the industry, respectively.

decreasing cost industry

An industry in which average total costs decrease as output increases and increase as output decreases when firms enter and exit the industry, respectively.

Monopoly

A theory of market structure based on three assumptions:

There is one seller,

it sells a product that has no close substitutes, and

the barriers to entry are extremely high.

Public Franchise

A firm’s government-granted right that permits the firm to provide a particular good or service and that excludes all others from doing so.

Natural monopoly

The condition in which economies of scale are so pronounced that only one firm can survive.

Perfect Competition vs. Monopoly

P ___ MR

P ___ MC

Price ______

Perfect Competition

P = MR

P = MC

Price Taker

Monopoly

P > MR

P > MC

Price searcher

deadweight loss of monopoly

The net value (the value to buyers over and above the costs to suppliers) of the difference between the competitive quantity of output (where ) and the monopoly quantity of output (where ); the loss due to not producing the competitive quantity of output.

X - Inefficiency

The increase in costs, due to the organizational slack in a monopoly, resulting from the absence of competitive pressure to push costs down to their lowest-possible level.

Price Discrimination

A price structure in which the seller charges different prices for the product it sells and the price differences do not reflect cost differences.

perfect Price Discrimination

A price structure in which the seller charges the highest price that each consumer is willing to pay for the product rather than go without it.

second degree Price Discrimination

A price structure in which the seller charges a uniform price per unit for one specific quantity, a lower price for an additional quantity, and so on.

third degree Price Discrimination

A price structure in which the seller charges different prices in different markets or charges different prices to various segments of the buying population.

Conditions of Price discrimination

The seller must exercise some control over price; that is, it must be a price searcher.

The seller must be able to distinguish among buyers who are willing to pay different prices.

Reselling the good to other buyers must be impossible or too costly.

Arbitrage

Buying a good at a low price and selling it for a higher price.

monopolistic competition

A theory of market structure based on three assumptions:

many sellers and buyers

firms producing and selling slightly differentiated products

easy entry and exit.

The perfectly competitive firm has ____ rivals all producing the same good with _______ substitutes

many, endless

in the perfectly competitive firm the elasticity of demand is so ____ that it is _____

high, horizontal

A monopoly firm has ______ ___ rivals and produces a good with _____ substitutes

practically no, no

In a monopoly firm the elasticity of demand is ___ so the demand curve is _____ ______

low, downward sloping

The monopolistically competitive firm has _____ rivals, producing a ______ ______ product

many, slightly differentiated

The monopolistically competitive firm has an elasticity of demand that is not as ____ as it faces a ______ sloping curve

high, downward

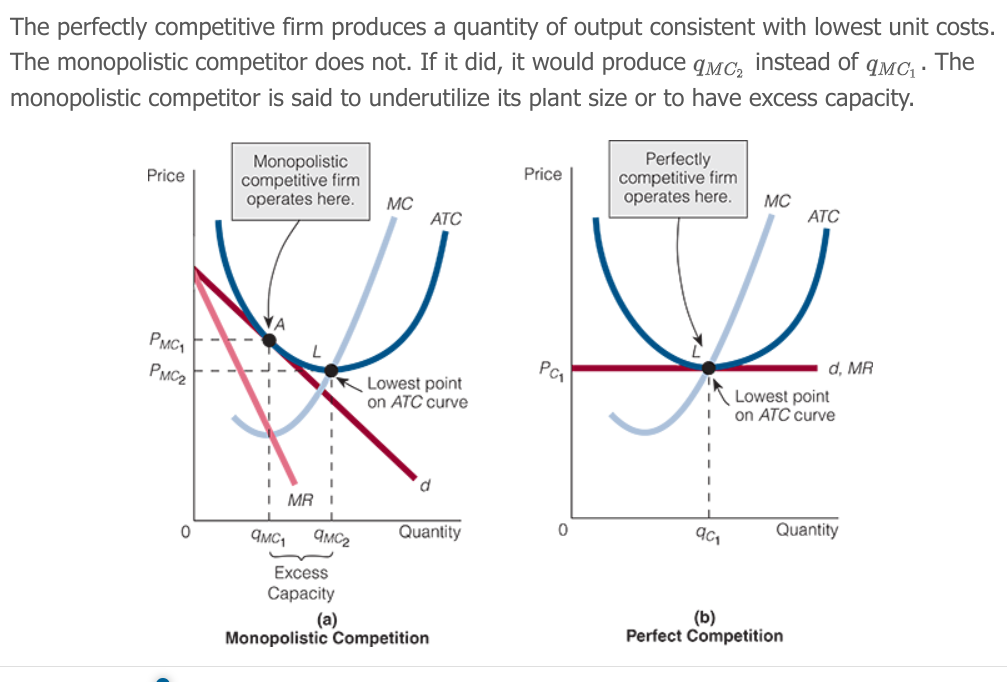

Excess Capacity Theorem

A monopolistic competitor in equilibrium produces an output smaller than the one that would minimize its costs of production.

oligopoly

A theory of market structure based on three assumptions:

few sellers and many buyers,

firms producing either homogeneous or

differentiated products, and significant barriers to entry.

Concentration ratio

The percentage of industry sales (or assets, output, labor force, or some other factor) accounted for by x number of firms in the industry.

(Cr4 = % industry sales accounted for by 4 largest firms)

(Cr8 = % industry sales accounted for by 8 largest firms)

A high concentration implies _____ make up the industry

few sellers

a low concentration implies _____ _____ __ ____ make up the industry

more than a few sellers

Cartel Theory

oligopoly firms act as one

(reduces output and increases price to increase joint profits)

Problems with a Cartel

Forming it

Forming Policy

entry into industry

cheating

Cartel Theory

A theory of oligopoly in which oligopolistic firms act as if there were only one firm in the industry.

Game Theory

A mathematical technique used to analyze the behavior of decision makers

What is the prisoners dilemma outcome?

individual rational behavior = inefficient joint outcome

When an oligopoly enters into a cartel it creates a _____ ______ so some ______ must enforce agreement

prisoner dilemma, entity

contestable market

A market in which

entry is easy and exit is costless,

new firms can produce the product at the same cost as current firms, and

exiting firms can easily dispose of their fixed assets by selling them.

Trust

A monopoly

A combination of firms that come together to act as a monopolist.

Antitrust law

Legislation passed for the stated purpose of controlling monopoly power and preserving and promoting competition.

Antitrust legislation =

helps create more competition, (more towards perfect competition

Sherman Act

Passed to deal with mergers of companies

Prohibits monopolies/combinations in restraint of trade.

(Basically = NO Monopolies)

Clayton Acts

Price discrimination (EX. different prices same product)

Exclusive dealing (EX. Selling to someone who cant use rival products)

tying contract (EX. arrangement where sale of one product is dependant on sale of another)

acquiring a competitor if that reduces competition

(basically made many business practices illegal)

Federal Trade Comission Act

Declares unfair methods of competition in commerce illegal

marked creation of FTC

(declares acts that are too aggressive in competition illegal)

Robinson-Patman Act

passed to increase small business success rate by protecting them from large chain stores

prohibits suppliers from offering special discounts to large chain stores only

wheeler-lea act

Empowers the FTC to deal with false and deceptive acts or practices (EX. False Advertising)

Celler-kefaver anti merger Act

closed merger loophole in Clayton act

market definition

defines whether or not a company is a monopoly

concentration ratios

gauges amount of competition in an industry

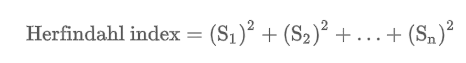

Herfindahl index

An index that measures the degree of concentration in an industry, equal to the sum of the squares of the market shares of each firm in the industry.

Horizontal merger

A merger between firms that are selling similar products in the same market.

vertical merger

A merger between companies in the same industry but at different stages of the production process.

conglomerate merger

A merger between companies in different industries.

network good

A good whose value increases as the expected number of units sold increases.

lock in effect

The situation in which a product or technology becomes the standard and is difficult or impossible to dislodge from that role.

How to regulate the natural monopoly

Price regulation

(MC Cost pricing)

profit regulation

(ATC = QD so only earns zero economic profit)

output regulation

(mandate quantity of output)

Regulatory lag

The period between the time a natural monopoly’s costs change and the time the regulatory agency adjusts prices to account for the change.

capture theory of regulation

A theory holding that, no matter what the motive is for the initial regulation and the establishment of the regulatory agency, the agency eventually will be captured (controlled) by the special interests of the industry being regulated.

(controlled by special interests of industries being regulated)

public interest theory of regulation

A theory holding that regulators are seeking to do—and will do through regulation—what is in the best interest of the public or society at large.

(controlled by interest of public or society)

public choice theory of regulation

A theory holding that regulators are seeking to do—and will do through regulation—what is in their best interest (specifically, to enhance their power and the size and budget of their regulatory agencies).

(controlled by wanting to enhance regulatory agency)

What theory/theories of regulation have lots of data?

Capture theory

public choice

What theory/theories of regulation have little data?

Public interest