Topic 6: Market Failures and Externalities

1/21

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

22 Terms

What do we mean by externalities?

=when our choices directly affect the well-being of others not involved in the transaction

Markets and externalities: how do these go together?

Competitive markets may allocate resources inefficiently (because MSB differs from MSC)

What two types of externalities are there?

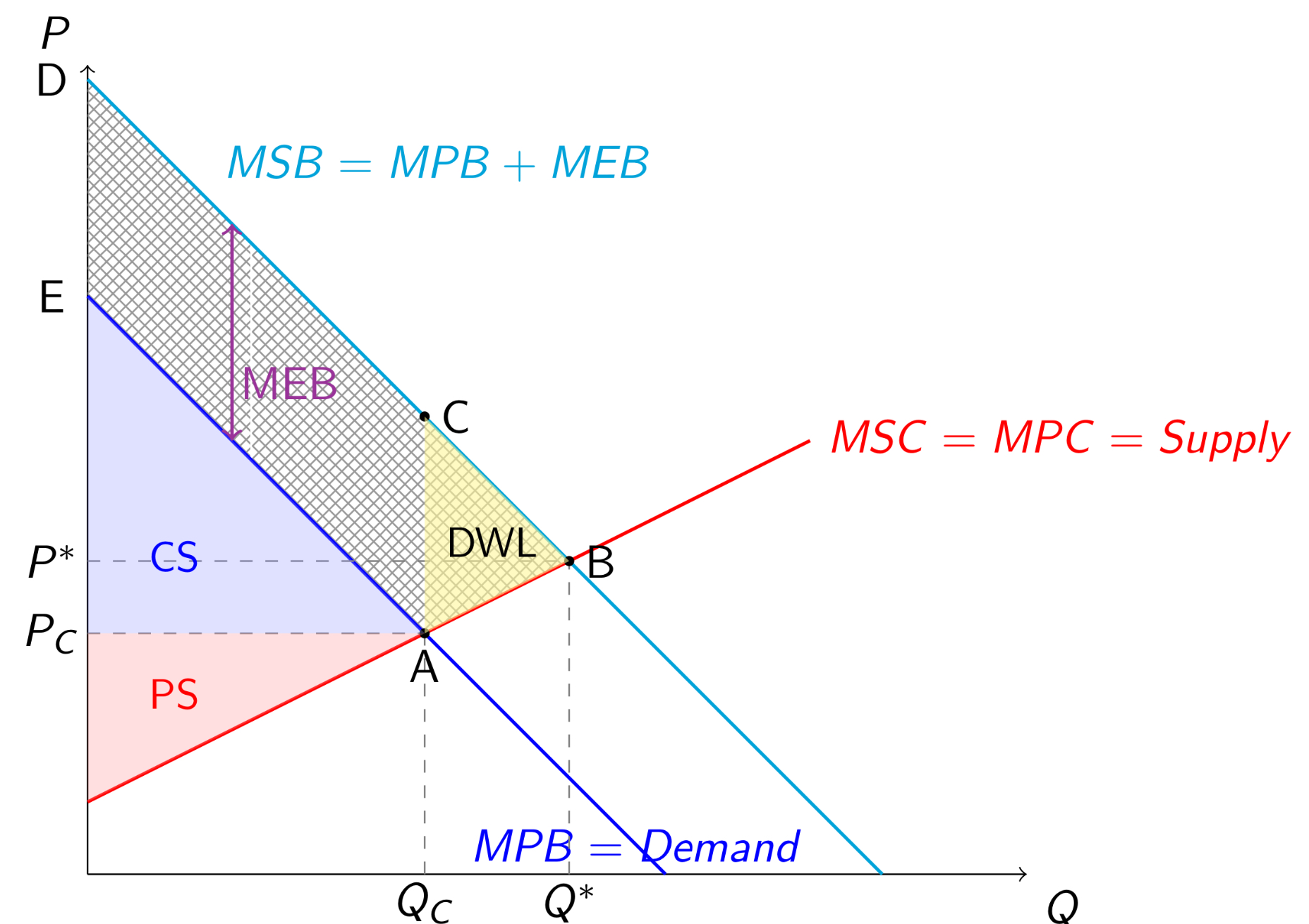

Positive externalities —> under-production

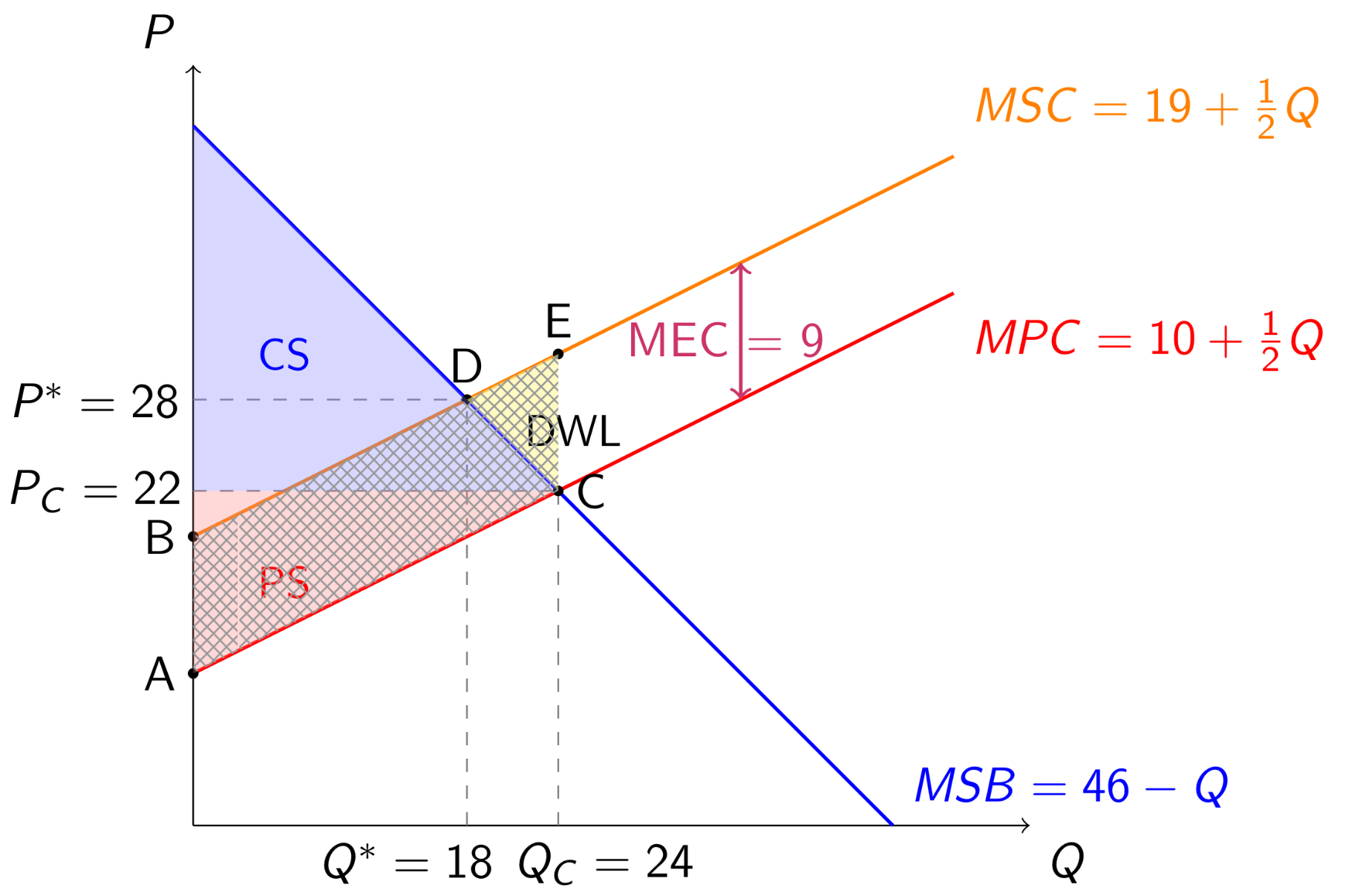

Negative externalities —> over-production

Positive externality (in consumption)

Pigouvian subsidy s = MEB

Negative externality (in production)

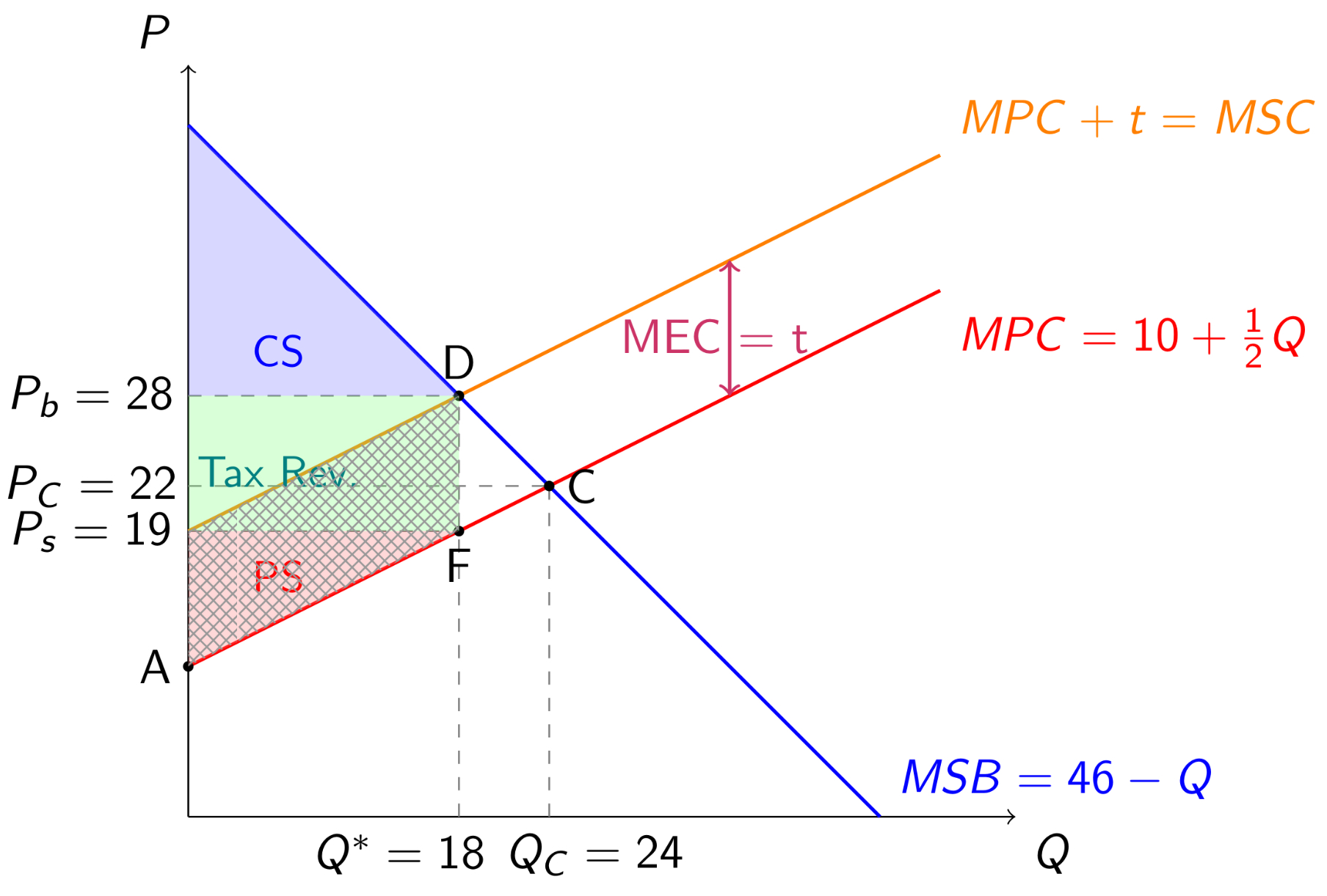

Pigouvian tax t = MEC

What is private parties’ role in this?

They have strong incentives to identify inefficiencies and negotiate mutually beneficial solutions

What can happen when the private sector fails to address externalities?

Government policies can potentially improve economic efficiency

What do we mean by ‘external cost’?

=the economic harm that a negative externality imposes on others

What do we mean by ‘external benefit’?

=the economic gain that a positive externality provides to others

Examples of negative externalities in production

A farmer spraying weedkiller that destroys his neighbour’s crop

Water, soil, and a air pollution

Carbon emissions and global warming

Inefficiency in competitive markets

Marginal Social Cost (MSC) = Marginal Cost (MC) + Marginal External Cost (MEC) —> Pollution

Marginal Social Benefit (MSB)= Marginal Benefit (MB) + Marginal External Benefit (MEB) —> Vaccines

When an externality is present…

private costs and/or benefits of an activity to the party who performs it differ from the social costs and/or benefits of that activity

How is an efficient outcome reached with externalities?

When MSC = MSB

Remedies for externalities: the public sector

Governments can remedy some externalities through policies that help the private sector create the necessary markets, for example:

by creating and operating those markets

by regulating the level of activities

by correcting private incentives through taxes, fees, subsidies or liability rules

In sum: for categories of governmental remedies for externalities

Policies that support the market

Quantity controls

Taxes, fees, subsidies

Liability rules

Policies that support markets —> to improve economic efficiency

Sometimes, governments can address externalities by helping the private sector create the necessary markets:

establish clear property rights

pass laws protecting property rights

enforce contracts

even creating and operating a market (e.g. ETS)

Quantity controls

E.g. the Emissions standard: a legal limit on the amount of pollution that a person or company can produce when engaged in a particular activity

Taxes, fees, and subsidies

Pigouvian taxation: the use of taxes/fees to remedy negative externalities

Pigouvian subsidisation: the use of subsidies to remedy positive externalities

Liability rules

These rules make the polluter financially responsible for the harm caused by others —> a way of internalising externalities when damages can easily be identified and assigned

Consequences of policy errors

Government information and choices are frequently imperfect —> Errors in setting a tax and a standard may have different implications: depending on the slopes of the curves, we might have greater/smaller DWL